All posts tagged "PAN CARD"

-

162MUST KNOW

162MUST KNOWAadhaar And PAN Card Not Linked Yet? Know How This Can Impact Your TDS

The government has been consistently reminding people to ensure their PAN (Permanent Account Number) and Aadhaar cards are linked together. The deadline...

-

212MUST KNOW

212MUST KNOWStruggling to surrender duplicate PAN card? You are not alone

Returning a duplicate PAN card has become a tedious task for many individuals, leading to frustration and financial difficulties. Read More: When does...

-

227MUST KNOW

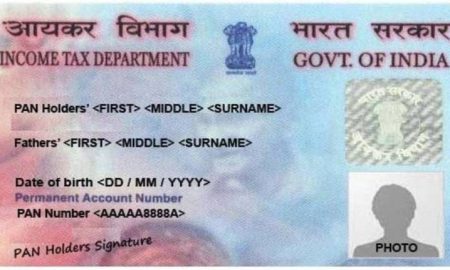

227MUST KNOWGet Your PAN Card Quickly: A Step-by-Step Guide To Online Application

APermanent Account Number (PAN) card is a unique, 10-character alphanumeric identifier issued by the Income Tax Department of India. It serves as...

-

186MUST KNOW

186MUST KNOWPAN Card Update: How To Change Photo And Signature In PAN Card

New Delhi: The PAN card, known as the Permanent Account Number, is a distinctive alphanumeric code issued by the Indian Tax Department, provided...

-

175MUST KNOW

175MUST KNOWHow To Correct/Change Your Name On PAN Card

New Delhi: PAN card or Permanent Account Number is a unique ten-digit alphanumeric number and is issued in the form of a laminated...

-

256MUST KNOW

256MUST KNOWHow To Verify PAN Card Online

New Delhi: The PAN card, or Permanent Account Number, is a vital document for Indian citizens. It serves both tax-related purposes and as...

-

152MUST KNOW

152MUST KNOWLost PAN Card? Here’s What You Should Do Immediately

New Delhi: The PAN card acts as one of the most crucial documents for the citizens of India. Permanent Account Number is a...

-

216ITR

216ITRIncome Tax Return: How To File ITR Online? Step By Step Guide

Income Tax Return (ITR) can be filed easily through e-filing portals, and apps or you can take the help of chartered accountants....

-

204ITR

204ITRTax Talk: NRIs must update status on PAN

Know India’s residency and source rules for taxation. If your stay in India exceeds 182 days in a financial year, you are...

-

160MUST KNOW

160MUST KNOWHow to check credit score using PAN card: Step-by-step guide

Your credit score is an important financial indicator that affects your ability to secure loans, credit cards, and even influences interest rates....