All posts tagged "Income Tax Act"

-

38ITR

38ITRAre personal loans taxable in India? Know income tax rules and deduction benefits

Personal loans are a widely used financial tool in India, offering quick access to funds for a range of purposes—be it education, healthcare, home...

-

163ITR

163ITRNew Income Tax Bill 2025 explained: Top 30 FAQs every taxpayer should check

New Income Tax Bill 2025: Finance Minister Nirmala Sitharaman introduced the New Income Tax Bill 2025 in Lok Sabha earlier this week....

-

205MUST KNOW

205MUST KNOWMoney and marriage: How is your alimony amount taxed after you get it after divorce settlement?

Money matters: Divorce can take a toll both emotionally and financially, as coping with the changes and new single status can be...

-

53ITR

53ITRPost Office Monthly Income Scheme (POMIS): Important Tax Rules for Investors

The Post Office Monthly Income Scheme (POMIS) is a reliable government-backed investment option offering fixed monthly income. However, it’s crucial to understand...

-

70ITR

70ITRIncome tax rules: How much cash can you receive in one day to avoid an I-T notice?

The income tax department carefully monitors high-value cash transactions, so taxpayers should exercise caution when engaging in them. Section 269ST of the...

-

82ITR

82ITR₹5,000 late fee: Your last chance to file belated income tax returns before December 31

Filing your ITR before the December 31 deadline is critical to avoid additional penalties and ensure compliance. Act now to avoid escalating...

-

129ITR

129ITRDirect Tax Code 2025: Individuals earning up to Rs 15 lakh to be benefitted once new tax laws in place, feel experts

The Centre is expected to unveil the Direct Tax Code 2025, the simplified version of the income tax laws, in the upcoming Union Budget...

-

79FINANCE

79FINANCESSY Transfer Rules: How To Move Your Sukanya Account From Post Office To Bank

The Sukanya Samriddhi Yojana ( SSY ) is a highly favored savings scheme aimed at securing the future of daughters. Launched under...

-

164MUST KNOW

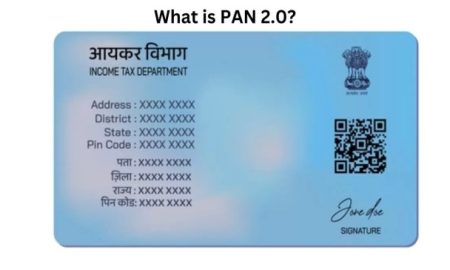

164MUST KNOWPAN 2.0: Rs 10,000 penalty for duplicate PAN card, how and why to check there is no duplicate PAN in your name

The government has announced the PAN 2.0 project. PAN Card 2.0 will be rolled out free of cost to all taxpayers. In...

-

109ITR

109ITRTax benefits on personal loans: How to save money legally

Personal loans are a convenient way to meet financial needs such as home renovations, medical emergencies, or even big-ticket purchases. However, many...