All posts tagged "HRA"

-

1.9KFINANCE

1.9KFINANCE7th Pay Commission: ऐसे होती है केंद्रीय कर्मचारियों की बेसिक सैलरी, भत्ते, पीएफ की गणना

नई दिल्लीः केंद्रीय कर्मचारियों को फिलहाल 7वें वेतन आयोग के हिसाब से सैलरी मिलती है. हालांकि आपको पता होना चाहिए कि सैलरी की...

-

2.2KITR

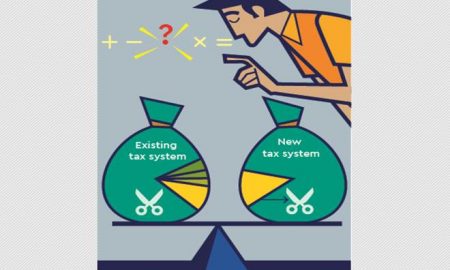

2.2KITROld tax regime or new regime: Making the smart choice

This year, while making their income tax declarations to employers for the purpose of tax deduction at source (TDS), taxpayers are facing...

-

2.0KITR

2.0KITRIncome Tax Alert for salaried! Higher TDS may be deducted if you fail to select tax regime on time

To facilitate the employer to deduct tax at source (TDS) from salary, employees need to declare their tax-saving investments in the beginning...

-

ITR

Your Income Tax Queries: NRIs do not need to quote Aadhaar in ITR or link PAN with Aadhaar

The CBDT vide notification 37/2017, has exempted non-residents from quoting Aadhaar in PAN applications and Income Tax Returns. Accordingly, if you’re a...

-

FINANCE

New Income Tax slabs 2020: Will your salary structure change in the coming year? Find out

Modi government has introduced optional new income tax slabs for the financial year 2020-21. The new income tax regime does away with...

-

FINANCE

No tax benefits on rent paid, home loan: Should you buy a house or stay on rent in new tax regime?

The tax benefits on House Rent Allowance (HRA) are great relief to salaried people who stay on rented accommodation as in certain...

-

FINANCE

From old income tax regime to new: What deductions you would lose and what would still be available?

In her second Budget, Finance Minister Nirmala Sitharaman has proposed a new income tax regime with lower income tax slab rates and...

-

FINANCE

4 dozen exemptions still available in new income tax structure

Tax breaks related to retirement benefit schemes such as Provident Fund (PF) and payments from Voluntary Retirement Schemes (VRS) have been retained,...

-

FINANCE

Do you earn between Rs 5-10 lakh? These factors decide your take-home salary

April and May are taxing times for both employers and employees alike. While most companies follow April to March as their performance...

-

ITR

Salaried? Avoid excess TDS with PPF, NPS, FD, Salary, Rent, Home Loan, HRA – Explained

Every penny counts! No one can probably understand the significance of this phrase better than salaried individuals navigating their daily lives with...