The income tax department has also noted that PAN cardholders failing to link the document with the Aadhaar card by March 31, 2022, could be slapped with a penalty of up to Rs 1000.

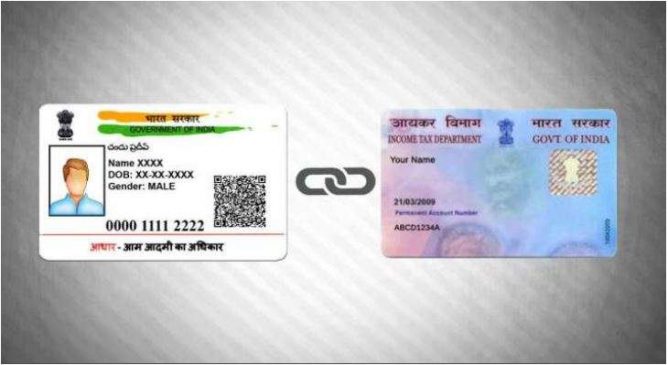

New Delhi: Permanent Account Number (PAN) will become inoperative after March 2023 if the cardholder fails it to link with the Aadhaar Card, the Central Board of Direct Taxes (CBDT) said on Wednesday, (March 30).

The income tax department has also noted that PAN cardholders failing to link the document with the Aadhaar card by March 31, 2022, could be slapped with a penalty of up to Rs 1000. Such cardholders, however, will be allowed to use the PAN Card till the time it goes inoperative in 2023.

Read More: PAN-Aadhaar linking deadline ends tomorrow, fine upto Rs 1,000 if you fail to do so

The deadline for linking the PAN card with the Aadhaar card has been extended by the income tax department several times. The current last date to link the crucial documents is March 31, 2022.

CBDT said that individuals who have been “allotted a PAN Card as of 1st July 2017, and is eligible to obtain Aadhaar Number, is required to intimate his Aadhaar to the prescribed authority on or before 31st March 2022.”

“On failure to do so, his PAN shall become inoperative and all procedures in which PAN is required shall be halted. The PAN can be made operative again upon intimation of Aadhaar to the prescribed authority after payment of a prescribed fee,” the department added.

Read More: Name or address wrong in Aadhaar card? Here’s how to fix Aadhaar details online

“However, till 31st March 2023 the PAN of the assessees who have not intimated their Aadhaar will continue to be functional for the procedures under the Act, like furnishing of return of income, processing of refunds etc,” CDBT said.