A sharp drop in the rupee — which slumped to a 20-month low against the US dollar — and unabated foreign fund outflows also weighed on the bourses, experts said.

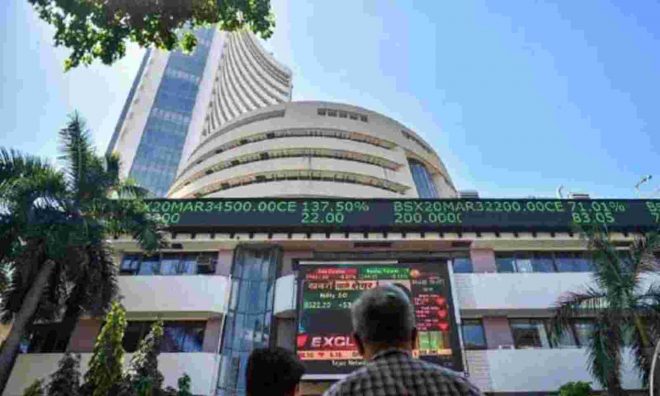

Mumbai: The Sensex and Nifty buckled under selling pressure for the fourth session on the trot on Wednesday as risk-off sentiment prevailed ahead of the US Federal Reserve’s policy decision.

A sharp drop in the rupee — which slumped to a 20-month low against the US dollar — and unabated foreign fund outflows also weighed on the bourses, experts said.

The 30-share BSE Sensex slumped 329.06 points or 0.57 per cent to end at 57,788.03. Similarly, the broader NSE Nifty fell 103.50 points or 0.60 per cent to 17,221.40.

Bajaj Finance was the top loser in the Sensex pack, dropping 3.10 per cent, followed by Bajaj Finserv, ITC, TCS, Titan, HCL Tech and HDFC.

On the other hand, Sun Pharma, Kotak Bank, M&M, Maruti, L&T and NTPC were among the gainers, spurting as much as 2.59 per cent.

The market breadth was negative, with 21 out of the 30 Sensex constituents finishing in the red.

“Anxiety over more anticipated hawkish policy statement by Fed pressurised the domestic indices to fall. Overall, Fed is expected to announce a faster end to its bond buying campaign and may signal a rate hike in 2022 amid rising inflationary pressure,” said Vinod Nair, Head of Research at Geojit Financial Services.

Read More:- Apple Closes in on $3-Trillion Market Value

Ajit Mishra, VP – Research, Religare Broking, said all eyes will be on the US Fed meeting later on Wednesday.

“While the majority expects that the committee would hold rates citing the possible challenges due to the new COVID variant, commentary on tapering, inflation and growth would be critical,” he noted.

Sector-wise, BSE realty, teck, IT, metal, utilities, oil and gas, telecom and finance shed up to 1.78 per cent, while auto, capital goods, bankex and consumer durables ended with gains.

Broader BSE midcap and smallcap indices dipped up to 0.59 per cent.

World stocks were in wait-and-watch mode ahead of a crucial US Fed policy decision where it is expected to announce a faster tapering of its massive bond buying program to control inflationary pressures.

Elsewhere in Asia, bourses in Shanghai and Hong Kong ended with losses, while Tokyo and Seoul were positive.

Stock exchanges in Europe were also trading on a mixed note in mid-session deals.

Read More:- No data on mob lynching in country: Centre in Parliament

Meanwhile, international oil benchmark Brent crude fell 0.90 per cent to USD 73.04 per barrel.

The rupee plunged 44 paise to an over 20-month low of 76.32 against the US dollar.

Foreign institutional investors remained net sellers in the capital markets, pulling out Rs 763.18 crore on Tuesday, as per provisional data.