Lost PAN card or damaged PAN card is a common occurrence for many taxpayers in India. The Income Tax Department has provided a hassle-free and easy way for taxpayers to apply for a new PAN card in case of lost PAN card. In this article, we look at the procedure to apply for a new PAN card, in lieu of a lost PAN Card.

Lost PAN Card Application

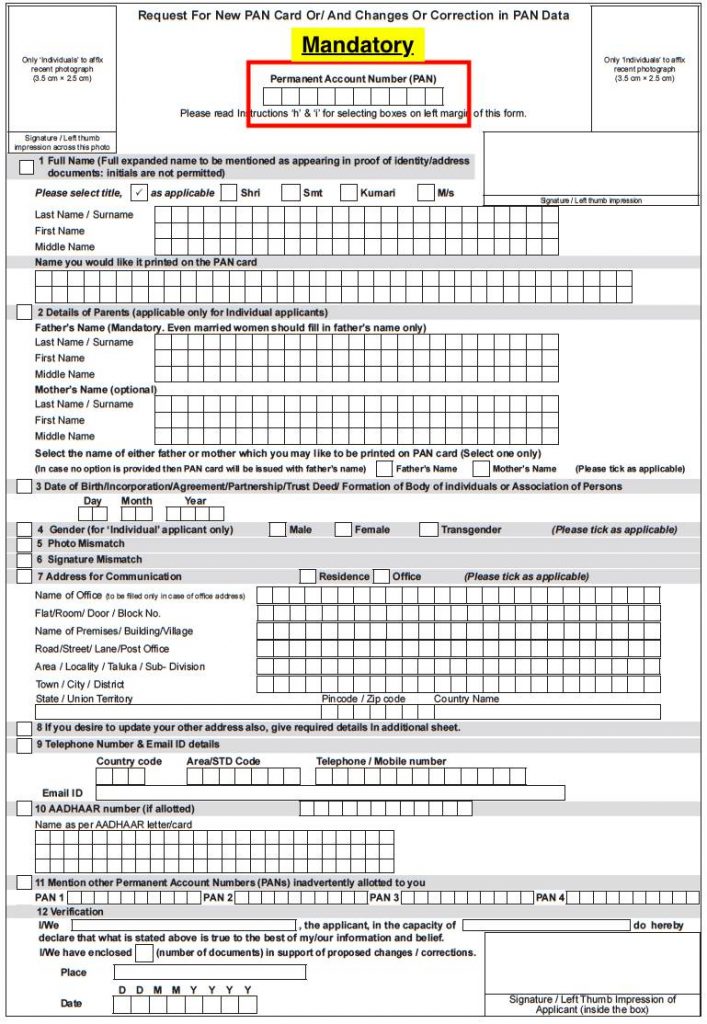

If a PAN card is lost an application for duplicate PAN card can be submitted using the Form for “Request for New PAN Card or/ and Changes or Correction in PAN Data” and a copy of FIR may be submitted along with the form. Submission of FIR is not mandatory, its optional only.

Follow the steps below to submit the lost PAN card application:

Step 1: You can reapply for a lost PAN card through the NSDL or UTI PAN Facilitation Centres or online through the website of NSDL or UTI.

- NSDL Lost PAN Application

Step 2: In case of lost PAN card, complete the form with the old PAN provided at the beginning of the application. Do not submit application for new PAN card. It is illegal for a person to possess more than one PAN. Hence, submission of the application without the old PAN mentioned at the beginning of the form could lead to a new PAN being generated.

Step 3: In case of any changes to the PAN, select the box on the left hand side of the form and update the information. In case of no changes, complete the form completely but do not select any box on left margin.

Step 4: Submit the documents required along with the application. For lost PAN card, proof of PAN must be submitted. Proof of PAN can be one of the following only:

- Copy of PAN card; or

- Copy of intimation letter issued by the Income Tax Department in lieu of PAN card intimating PAN.

- In case one of the above proofs are not available, a copy of FIR (stating loss of PAN card) can be submitted.

If proof of PAN (as stated above) is not submitted, the application will be processed on a ‘good effort’ basis even without a copy of FIR. However if it is found that there are differences between the PAN or the data provided in the application with the Icome Tax Department database, the application may not be processed and the processing fee will be forfeited.

Step 5: Pay the PAN card processing fee. If the communication address of the taxpayer is within India, then the fee for processing new PAN application will be Rs.110. If the communication address of the taxpayer is outside of India, then the fee for processing PAN application will be Rs.1020.

Step 6: On confirmation of successful payment, a 15 digit unique acknowledgment will be generated. The applicant must save and print the acknowledgement.

Step 7: Sign the application and place a photo of the applicant along with signature or thumb impression in the place provided. Attach a copy of the old PAN card or intimation letter issued by IT Department or FIR.

Step 8: Send the completed application to NSDL or UTI. The address for NSDL is as follows:

- Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8,Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016.

Forgot PAN

If the PAN card is lost and you do not remember your PAN, then before filing the lost PAN card application, use the “Know Your PAN” facility on the Income Tax Department website. Using “Know Your PAN”, by entering details like Name, Father’s Name and Date of Birth, you can find your PAN.

For more updates: Like us on Facebook and follow us on Twitter & Instagram.