The bulk of the EMI in the initial years is for servicing interest. So, you should consider prepaying the home loan during the initial years

The decision to prepay your home loan should be a well thought out one. What is the best time to do so? We will discuss this aspect here with an example.

Let’s say you take a home loan of Rs 75 lakh for 25 years at 7.5 percent rate of interest. You will now have to pay an EMI of Rs 55,424 per month. And during the course of 25 years, you will repay the principal of Rs 75 lakh plus interest of Rs 91.2 lakh.

High interest component

Now if you don’t know how home loan EMIs work, then here is a brief but important refresher. EMI is made up of the principal and the interest parts. During the initial years, a major part of your EMI goes towards interest, while a small part goes towards principal repayment. How do we know this?

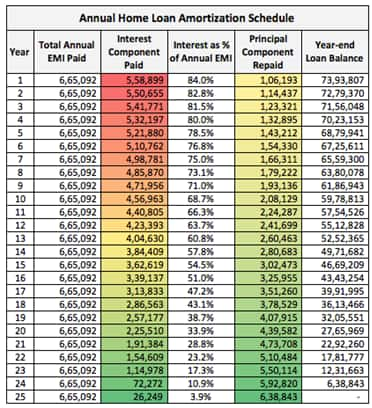

Have a look at the annual loan amortization schedule for your loan of Rs 75 lakh:

As you can see, in the first year, almost 84 percent of your EMIs go only towards interest servicing. Only 16 percent of the Rs 6.65 lakh annual EMI (12 x Rs 55,424) goes towards principal repayment. Fast forward to the 10th year, and the interest component reduces to 69 percent. Further down in the 20th year, it’s down to 34 percent.

So, every month, the interest component in the EMI decreases a bit while the principal repayment part rises. Remember that the monthly EMI still remains the same.

Prepaying in the initial years

What is happening is that the bulk of the EMI in the initial years is for interest servicing. And it is for this very reason that you should consider prepaying the home loan during the initial years. Let’s continue our example further to understand this.

Suppose you get a bonus from your company (or sold your ESOPs) and want to make a one-time partial prepayment of Rs 15 lakh.

Now, when you make the prepayment will decide how much it benefits you. Let’s compare three scenarios. No prepayment versus prepayment in the second year versus making it in the 12th year:

No Prepayment: If you don’t make any prepayment, then the total interest paid will be Rs 91.2 lakh. Loan Tenure will remain the original 25 years. If you start your home loan in Jan-2021, it will run till Dec 2045.

-Prepayment of Rs 15 lakh in 2nd year: Total interest paid would reduce to Rs 47.1 lakh! So, you save a massive Rs 44 lakh and your loan (if taken in Jan-2021 and prepayment made in Dec 2022) will close in Feb 2037. You save money and the tenure reduces by eight years!

-Prepayment of Rs 15 lakh in the 12th year: Total interest paid would reduce to Rs 73.4 lakh! So you save a smaller Rs 18 lakh and your loan (if taken in Jan 2021 and prepayment made in Dec 2032) will close in Jan 2041.

So, prepaying an amount earlier in the tenure is more profitable than prepaying the same amount later on.

I have kept the interest rate constant at 7.5 percent for simplicity.

Steady repayment

And what if you don’t have lump-sum to prepay? What if you want to begin monthly prepayment of extra Rs 10,000? Here is your answer:

–Begin Prepaying Rs 10,000 monthly from the third year: Total interest paid would be Rs 63.1 lakh.

-Begin Prepaying Rs 10,000 monthly from the 13th year: Total interest paid would be Rs 83.3 lakh.

So even in the case of monthly prepayments, the sooner you start, the better. And just an extra few thousand every month reduces your interest liability to much lower levels.

For many, getting their hands on surplus lump-sum is difficult. But paying a few extra thousand every month is more practical. And this in itself can save a lot of money for them during the course of the loan.Prepaying is welcome. But don’t be too aggressive with home loan repayment. It can hurt other aspects of your financial life.