One97 Communications Limited (OCL), which runs Paytm, On April 17 has started the customer migration to partner payment service provider (PSP) banks Axis Bank, HDFC Bank, SBI and Yes Bank.

Read More: Petrol, Diesel Fresh Prices Announced: Check Rates In Your City On April 18

The Paytm UPI customers were until now using Paytm Payments Bank Limited (PPBL), an associate company of OCL as the PSP bank, which became untenable after RBI’s crippling sanctions on PPBL.

A PSP is a bank that helps the UPI app to connect with the banking channel. Only banks can act as PSPs.

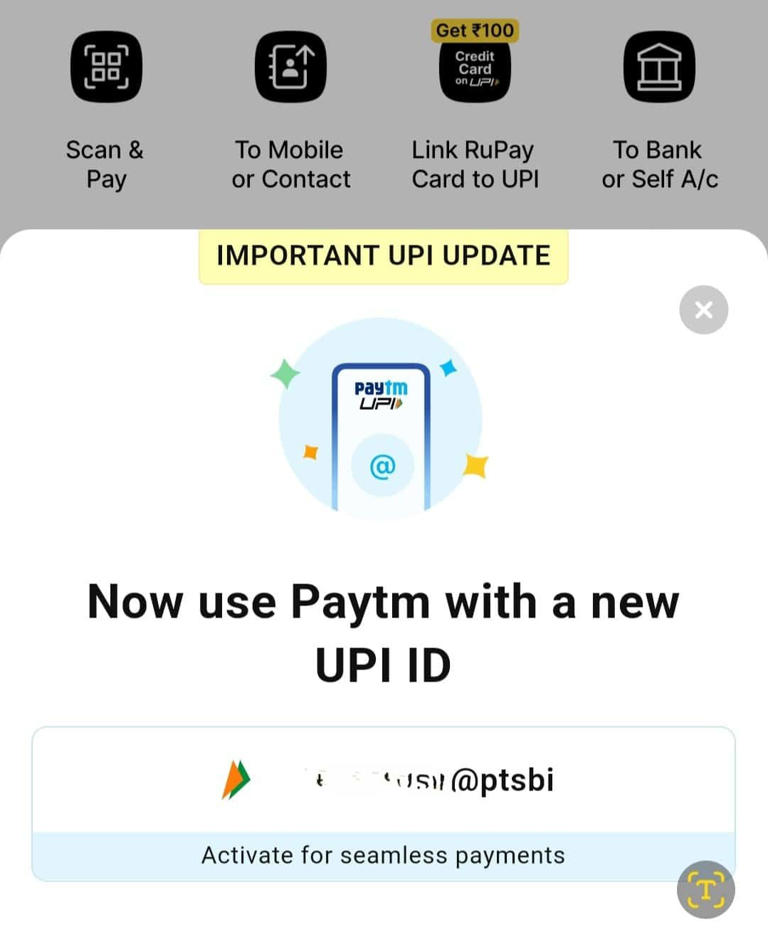

All Paytm UPI users will be nudged for consent with a pop-up notification for using Paytm with a new UPI ID with one of the four handles like @ptsbi, @pthdfc, @ptaxis and @ptyes.

Read More: How To Book Online Train Ticket On Indian Railways’ UTS Mobile App

“Following NPCI’s approval on March 14, 2024, to onboard OCL as a Third- Party Application Provider (TPAP), Paytm has expedited the integration with Axis Bank, HDFC Bank, State Bank of India (SBI), and YES Bank. All four banks are now operational on the TPAP, streamlining the process for

Paytm to shift user accounts to these PSP banks,” the company said in a statement to stock exchanges.

NPCI on March 14 granted approval to OCL to participate in UPI services as a TPAP under the multi-bank model. The much-awaited license would allow Paytm to continue offering UPI services to its app users, after its banking unit PPBL ceased operations post-March 15 following regulatory action.

Paytm has seen its UPI market share drop to nine percent in March, its lowest level in the last four years, according to data available on the National Payments Corporation of India (NPCI) website. NPCI runs UPI.

Read More: Lok Sabha Polls 2024: How to download digital voter card for Digilocker

In February, it had dropped to 11 percent from the previous month after RBI’s crippling restrictions on its associate company Paytm Payments Bank Limited (PPBL).