Senior citizen fixed deposits (FDs), specifically tailored for individuals aged 60 and above, offer attractive interest rates and various benefits. However, before diving into this investment avenue, it’s crucial to understand the nuances and considerations associated with senior citizen fixed deposits.

These are specialised FD schemes offered by banks and financial institutions exclusively for individuals above the age of 60. These FDs typically offer higher interest rates compared to regular fixed deposits, making them an appealing investment option for retirees or those nearing retirement. Here are some of the key benefits of senior citizen FDs.

Read More: This Small Finance Bank Gives 8.50% Returns On Fixed Deposits Of 15 Months

Higher Interest Rates

Senior citizens often enjoy preferential interest rates on fixed deposits, providing an additional source of income to supplement their retirement funds. Fixed deposits are considered one of the safest investment avenues, offering guaranteed returns and protection of the principal amount invested.

FD interest payouts can provide senior citizens with a steady stream of income, helping to cover living expenses and maintain financial stability during retirement.

Flexible Tenures

Senior citizen FDs offer flexibility in choosing the deposit tenure, ranging from short-term to long-term options, based on individual preferences and financial goals.

Here Are Key Considerations Before Investing

Interest Rates and Tax

Compare the interest rates offered by different banks and financial institutions for senior citizen FDs. Opt for institutions offering competitive rates to maximize returns on your investment.

Understand the tax implications of FD interest income, especially if it exceeds the tax-exempt threshold. Senior citizens are eligible for a higher tax exemption limit on interest income earned from FDs, subject to certain conditions.

Tenure and Liquidity

Assess your liquidity needs and choose FD tenures accordingly. While longer tenures typically offer higher interest rates, they may limit access to funds in case of emergency. Consider a mix of short-term and long-term deposits to balance liquidity and returns.

Penalties for Premature Withdrawal

Be aware of penalties or charges associated with premature withdrawal of FDs. Ensure you have a clear understanding of the terms and conditions regarding early withdrawals before committing your funds.

Read More: Rupee Declines 5 Paise To 82.95 Against US Dollar On firm Crude Prices

Renewal Options

Evaluate the renewal options available for senior citizen FDs. Some institutions offer automatic renewal facilities, allowing for seamless reinvestment of matured deposits at prevailing interest rates.

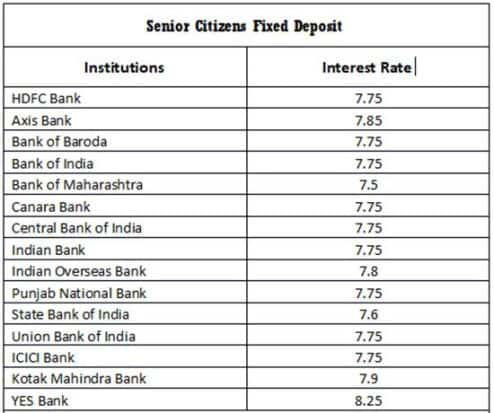

Before investing in senior citizen FDs, it’s important to carefully evaluate interest rates, tax implications, liquidity needs, and renewal options. By considering these key factors and conducting thorough research, senior citizens can effectively leverage their investment. The table below compares the interest rates of different banks to help you take a decision based on your requirements.

Data as on respective banks’ website on 12 March 2024. Highest interest rate on term deposits for senior citizens; Deposit amount below Rs 2 cr for public & private banks considered for data compilation. The rates are subject to change and vary from institutions. Banks whose websites don’t mention the data are not considered.

Compiled by BankBazaar.com