Question: What is the last date to pay advance tax for Financial Year (FY) 2023-24? What are the consequences in case of non-compliance with the advance tax due date?

Answer by Dr. Suresh Surana, Founder, RSM India: Every person whose estimated tax liability is Rs 10,000 or more during a particular financial year would be liable to pay advance tax (except persons aged 60 years or more not deriving any income from business or profession who are exempt from paying advance tax). Advance tax is computed on the consolidated income earned and expected to be earned from various sources (i.e., salary income, rent income, interest income etc.) during the financial year, after adjusting the applicable deductions, exemptions, TDS/TCS credit, etc.

Read More: Did You Pay Advance Tax? Check Deadline For Payment Before Getting Notice From Income Tax Dept

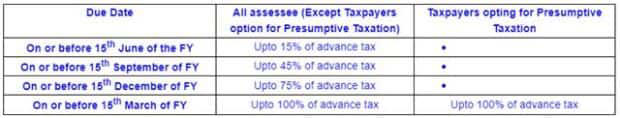

Generally, advance tax payments are required to be paid in specified installments every quarter on or before the specified due dates provided u/s 211 of the I-T Act, failing which the taxpayer would be subjected to certain interest consequences.

It is pertinent to note that any amount paid by way of advance tax on or before the 31st March shall also be treated as advance tax paid during the financial year.

Read More: Deadline to file updated ITR FY20-21 ends on March 31: Details on additional tax

Taxpayers failing to pay their advance taxes in due time would be subject to the following interest consequences:

* As per section 234B of the I-T Act, if the taxpayer has either failed to pay the advance tax or the advance tax paid by the taxpayer is less than 90% of the assessed tax, he/she shall be liable to pay simple interest at 1% per month or part of a month for default in payment of advance tax. Such interest should be computed from the first day of the assessment year, i.e., from 1st April till the date of determination of income under section 143(1) or where a regular assessment is made, then till the date of such a regular assessment.

Read More: Received a tax mismatch notice from the IT department? Here is how to set it right

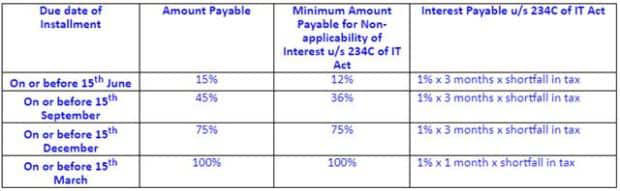

* Section 234C of the I-T Act provides for levy of interest for default in payment of installment(s) of advance tax:

It is pertinent to note that taxpayers shall not be liable to any interest liability u/s 234C of the I-T Act if the shortfall in payment of tax is due to certain specified incomes such as capital gains, casual winnings such as winnings from lottery, crossword puzzles, etc. and the taxpayer pays the required advance tax on such income as a part of immediate following instalments or till 31st March, if no instalment is pending.