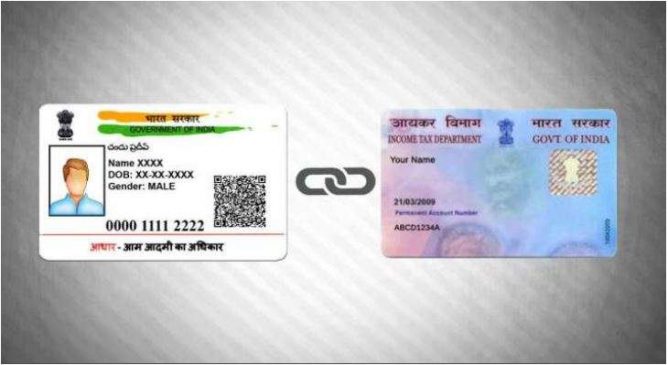

The government has been consistently reminding people to ensure their PAN (Permanent Account Number) and Aadhaar cards are linked together. The deadline to do the same expired last year on June 30, 2023. As such, the authorities revealed earlier last month that they collected a penalty of over Rs 600 crore from defaulters who failed to link both these documents.

While there are many disadvantages you might have to bear if your Aadhaar Card and PAN card isn’t linked, one of the major ones is the impact it can have on your TDS (Tax Deducted at Source).

Read More: Have unclaimed deposits in banks? Here’s how you can claim them, as per RBI rules

TDS Deduction

TDS is the tax deducted by the employer (deductor) before adding the income to the payee’s account. This deducted amount is later given to the government on behalf of the payee. The TDS deducted differs for every individual and depends on several factors like the nature of income and the PAN status of the individual.

Further, if your PAN card isn’t linked with the Aadhaar, it renders the PAN ‘inoperative’. The last deadline given by the government to link both the documents was June 30, 2023. The ‘inoperative’ PAN status will mean a higher TDS rate of 20 per cent for individuals.

There are several situations where this surplus TDS could cause a major impact on your savings and income.

Read More: Pradhan Mantri Fasal Bima Yojana: How to sign in and register online for PMFBY — Know Details

Property Purchase

Generally, when buying a property, the buyer has to pay a TDS of 1 per cent while paying the seller for a property valued Rs 50 lakh or more. In case of an unlinked PAN, this TDS rate will climb to 20 per cent, burning a major hole in your pocket.

Fixed Deposits and Interest Income

Banks generally charge a TDS of 10 per cent on interest earned from Fixed Deposits (FDs). This rate jumps to 20 per cent for an inoperative PAN user. Further, you are also barred from submitting Form 15G/H which allows you to claim exemption from TDS deduction.