SBI, HDFC Bank and ICICI Bank continue to be identified as Domestic Systemically Important Banks

The Reserve Bank of India (RBI) on Thursday said state-owned State Bank of India (SBI) and private sector lenders ICICI Bank and HDFC Bank continue to be domestic systemically important Banks (D-SIBs). SIBs are institutions that are ‘too big to fail’.

This perception of ‘too big to fail’ creates an expectation of government support for these lenders in times of distress. Due to this, these banks enjoy certain advantages in the funding markets.

“SBI, HDFC Bank and ICICI Bank continue to be identified as Domestic Systemically Important Banks (D-SIBs),” the RBI said in a statement on Thursday.

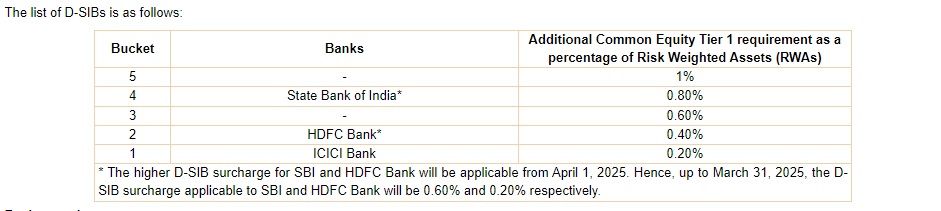

While ICICI Bank continues to be in the same bucketing structure as last year, SBI and HDFC Bank move to higher buckets – SBI shifts from bucket 3 to bucket 4 and HDFC Bank shifts from bucket 1 to bucket 2.

Read More: Now, get Bharat brand rice from government at subsidized rate of Rs 25 per kg

“For SBI and HDFC Bank, the higher D-SIB buffer requirements on account of the bucket increase will be effective from April 1, 2025,” the RBI said.

The Additional Common Equity Tier 1 requirement as a percentage of Risk Weighted Assets (RWAs) is 0.20 per cent for Bucket 1, 0.4 per cent for Bucket 2, 0.6 per cent for Bucket 3, 0.8 per cent for Bucket 4, and 1 per cent for Bucket 5.

The additional Common Equity Tier 1 (CET1) requirement for D-SIBs was phased-in from April 1, 2016 and became fully effective from April 1, 2019. The additional CET1 requirement will be in addition to the capital conservation buffer.

Read More: Petrol, Diesel Fresh Prices Announced For December 28: Check Fuel Rates In Your Cit

The framework for dealing with D-SIBs was issued in July 2014. The framework requires the RBI to disclose the names of banks designated as D-SIBs starting from 2015 and place these lenders in appropriate buckets depending upon their Systemic Importance Scores (SISs).

Based on the bucket in which a D-SIB is placed, an additional common equity requirement has to be applied to it.

The Reserve Bank of India (RBI) had announced SBI and ICICI Bank as D-SIBs in 2015 and 2016.