At 9:47 am, Zomato shares recovered some of their intraday losses to trade 1.9 per cent weaker for the day at Rs 124.7 apiece on the bourse.

Zomato shares succumbed to selling pressure on Thursday after the food delivery company received a show-cause notice of Rs 402 crore from the Pune Zonal Unit of the Directorate General of GST Intelligence. The stock of Zomato fell as much as three per cent to Rs 123.2 apiece on BSE in early deals.

Read More: HRH Next Services IPO Day 2: Check Subscription Status, GMP Today

At 9:47 am, Zomato shares recovered some of their intraday losses to trade 1.9 per cent weaker for the day at Rs 124.7 apiece on the bourse.

In a regulatory filing post-market hours on Wednesday, Zomato said it had received the notice that required it to show why an alleged tax liability of Rs 401.7 crore along with interest and penalty, for the period from October 29, 2019, to March 31, 2022, should not be demanded from the company.

Read More: Stock Market Updates: Sensex Rises 200 pts, Hits Fresh High; Nifty Tops 21,700 For First Time

The amount alleged in the notice is based on the amounts collected as delivery charges from the customers on behalf of the delivery partners during the referred period, according to the filing.

Zomato said it strongly believes that it is not liable to pay any tax since the delivery charge is collected by Zomato on behalf of the delivery partners. The contractual terms and conditions mutually agreed upon, the delivery partners have provided the delivery services to the customers and not the company, it said.

Zomato said it would be filing an appropriate response to the notice.

Read More: Stocks to Watch: Azad Engineering, SBI, Zomato, Bata, Adani Shares, Paytm, and Others

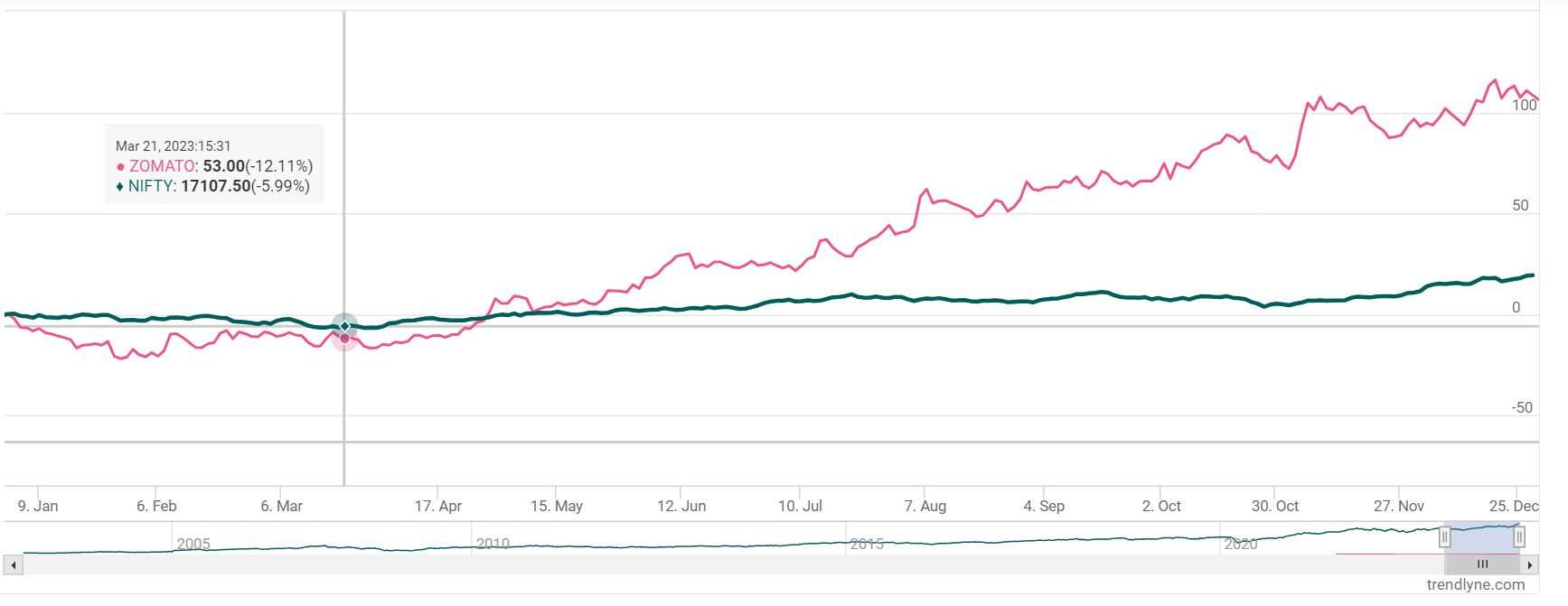

Zomato share price: Past performance

Zomato shares have more than doubled investors money in 2023 so far, sharply outperforming a rise of 19 per cent in the headline Nifty50 index.