PPF Account: When one starts investing, how to become rich is the common goal that an earning individual looks at. But, in recent months, due to the Coronavirus crisis, the way unit linked plans have underperformed and various other investment classses tanked before rising again, the common man has understood the meaning and benefit of government-backed small savings schemes. The Public Provident Fund (PPF) scheme is one of them. PPF account opening is a popular long term investment option backed by the Government of India, which offers safety with an attractive 7.1 per cent interest rate and returns that are fully exempted from tax. Investors can get the facilities such as loan, withdrawal and extension of account as well.

Speaking on the PPF account, SEBI registered tax and investment expert Jitendra Solanki said, “PPF account gives EEE benefit to the investor up to Rs 1.5 lakh in one financial year. Means, one can avail of income tax exemption on up to Rs 1.5 lakh investment in PPF account, while the account holder is eligible for tax exemption on the PPF interest earned and PPF maturity amount at the time of withdrawal.”

He, however, said that it is critical for investors to know one thing and that is, that this EEE benefit is available for only those earning individuals who file their Income Tax Return (ITR) by opting for the old income tax slab.

Solanki went on to add that in PPF, the maturity period is 15 years while the PPF interest rate being given by the government these days is 7.1 per cent.

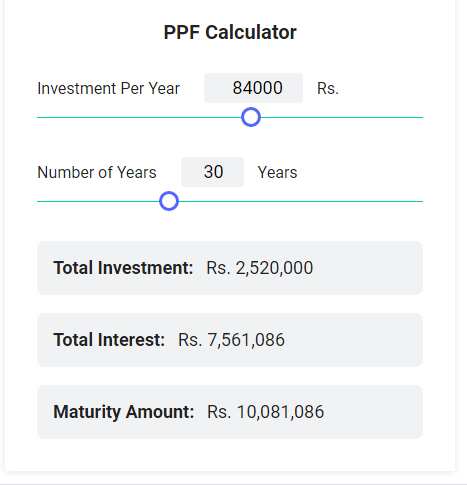

So, assuming 7.1 per cent average returns that one would get in the entire period of maturity period of 15 years, suppose one invests Rs 7,000 per month in one’s PPF account, then the PPF calculator suggests that one’s PPF maturity amount after 15 years will be Rs 24,41,889. During the investment period, one will get income tax exemption on one’s Rs 84,000 annual PPF investment while the maturity amount and the PPF interest earned during the period will be 100 per cent income tax exempted.

However, this will not turn investors into a crorepati. For that, some other tricks must be employed.

One can extend PPF account beyond 15 years of maturity period by submitting form-H within one year of the maturity period. By doing this one can continue to avail the EEE benefits in one’s PPF account.

Speaking on the PPF account extension rules, another SEBI registered tax and investment expert Manikaran Singhal said, “One can extend one’s PPF account in a block of 5 years by submitting form-H within one year of the PPF account maturity. There is no limit on PPF account extension but every time the account holder will have to submit Form-H within one year of the maturity and the extension will be always in a 5 years block.”

This will turn a PPF investor into a crorepati!

Means, if a PPF account holder wants to invest for 30 years, the investor will have to submit Form-H thrice after 15, 20 and 25 years of PPF account opening. As per the tax and investment experts mentioned above, one can start investment at the age of around 30 years and continue to invest for next 30 years till retirement. If an investor does that then its maturity amount will grow up to massive Rs 1,00,81,086.

So, one can become a crorepati by investing in the government-backed 100 per cent risk free Public Provident Fund account.