In Q1 2022, of approx. 99,550 units sold in the top 7 cities, 36% were launched during the same quarter.

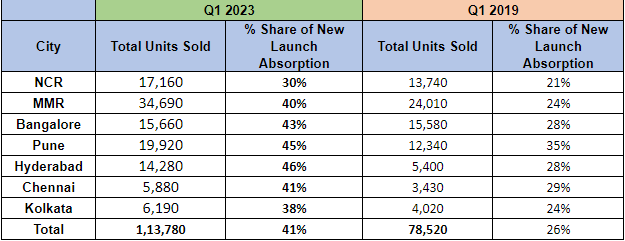

While ready-to-move-in homes still top the wish-list of most home seekers in the top 7 cities, newly launched units are gaining increasing acceptance. This traction has been building up ever since branded developers started cornering the fresh supply market with projects that elicit buyer confidence and have all the features they seek. Latest Anarock Research data shows that out of approx. 1.14 lakh homes sold in Q1 2023 across the top 7 cities, over 41% were in newly launched projects.

Read More: Godrej Properties on Land-buying Spree for Housing Projects; to Acquire Rs 15k-cr Projects in FY24

At 30%, NCR saw the lowest sales share of newly launched units in Q1 2023. Another city with comparatively low fresh supply absorption share is Kolkata at 32%. Interestingly, Mumbai Metropolitan Region (MMR), which saw the second lowest absorption of newly-launched units in Q1 2019 with a 24% share, saw its sales share of new units jump to 40% in Q1 2023.

Notably, the sales share of newly launched homes was much lower in the corresponding period of 2019, when just 26% of approx. 78,520 sold homes were in new projects. In Q1 2022, of approx. 99,550 units sold in the top 7 cities, 36% were launched during the same quarter.

Read More: Luxury homes in NCR hit a new high: Sales surge by 216%

Among the top 7 cities, Hyderabad accounted for the highest sales share of new units. Of approx. 14,280 units sold there in Q1 2023, approx. 46% were launched in the same period. NCR saw the lowest absorption of newly launched homes – of 17,160 units sold in Q1 2023, just 30% were launched during the quarter. The remaining units sold were in projects launched before Q1 2023. However, NCR has seen remarkable change in the given period.

City-wise Absorption Trends

Anuj Puri, chairman, Anarock Group, said, “For the longest time, ready-to-move-in homes remained in highest favour with homebuyers because of the previously abysmal project completion track record in many areas of the country. This is now changing – under-construction homes in new launches are increasingly finding takers, though ready-to-move homes retain the top demand slot.”

Read More: MahaRERA Asks Mirabilis’ Builders To Refund Money To 12 Allottees

There are two reasons for this, explains Puri.

“Firstly, much of the new supply is by well-funded branded developers who will comply with RERA regulations and complete their projects as per schedule. In Q1 2023, of 1.14 lakh new units launched in the top 7 cities, the branded vs non-branded developer share ratio stood at 59:41 while back in 2015, it was the reverse at 41:59. Secondly, investors are back on the housing market. Early-stage under-construction homes offer the kind of cost arbitrage that make residential real estate attractive to investors, who have largely given housing a miss over the last 3-4 years. It is a heartening trend for the residential market in the remaining 2023.”

This trend bears watching, as it has strong mid-to-long-term implications for the Indian residential property market. While the return of investors is positive for overall sales, an end-user driven market helps keep prices in check, the research said, adding that accelerated investor activity has historically led to unreasonable price hikes which eventually throttled back the overall housing market growth story.