Depositors should select their FD tenures after factoring in their investment horizon and FD slab rates offered by their banks.

Currently, many small finance banks and some private sector banks are offering fixed deposit slab rates of 7.5% p.a. or above. As these small finance banks and private sector banks have been classified as scheduled banks, their depositors are covered under the Depositor Insurance Program of DICGC, an RBI subsidiary.

Read More: Super Senior Citizen Fixed Deposit interest rate increased by BoI. Get 7.65% on 1-year FD

This insurance program covers each depositor of each scheduled bank for cumulative deposits (including fixed, current, savings and recurring deposits) of up to Rs 5 lakh, in case of bank failures.

“Thus, depositors with low risk appetite can spread their FDs among multiple scheduled banks offering high FD yields in such a way that the cumulative deposits with each of those banks do not exceed Rs 5 lakh,” advises Naveen Kukreja, Co-Founder & CEO, Paisabazaar.

Depositors should select their FD tenures after factoring in their investment horizon and FD slab rates offered by their banks. They can book FDs for longer tenures if those match their investment horizons and/or the corresponding FD rates are significantly higher than the rates offered for medium or shorter tenures.

“Depositors should also avoid the auto-renewal option while booking FDs. This would allow them to select FD tenure, at the time of renewal, on the basis of their investment horizon and the FD rate slabs offered by the banks at that time,” adds Kukreja.

Read More: Corporate Fixed Deposits Giving Returns Up To 8.35%. Check The Latest Interest Rates Here

Depositors looking for regular income or cash inflows from their fixed deposits should opt for non-cumulative fixed deposits. Banks and NBFCs/HFCs usually offer monthly and quarterly pay-out options on their non-cumulative fixed deposits. However, some banks and NBFCs/HFCs also additionally offer half yearly and annual pay-out options. Depositors should select the pay-out option after factoring their cash flow requirements.

Depositors who do not require regular income from their FDs and wish to save for their financial goals should opt for cumulative fixed deposits. As the interest component is re-invested in these fixed deposits, the accrued interest itself starts earning interest on its own. Thus, the power of compounding kicks in, allowing the depositor to earn higher interest income than non-cumulative fixed deposits.

Many depositors have FDs booked at much lower interest rates during the low interest rate regime. They should opt for pre-mature FD closure only if they find a significant gap between the new FD rates and the effective rates on their existing FDs after accounting the premature withdrawal penalty.

Read More: BoI hikes FD rates for 1 year tenor, to offer up to 7.65 pc to senior citizens

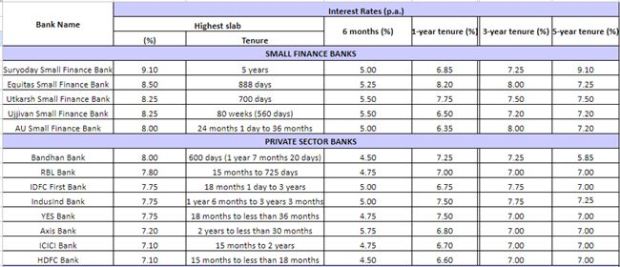

Here is a list of the highest fixed deposit interest rates offered by different public and private sector banks as well as small finance banks:

Highest Fixed Deposit Interest Rates Offered By Different Banks