Sensex Today: Broader indices, which include Nifty Midcap 100 and Nifty Smallcap 100 indices, however, outperformed benchmark indices.

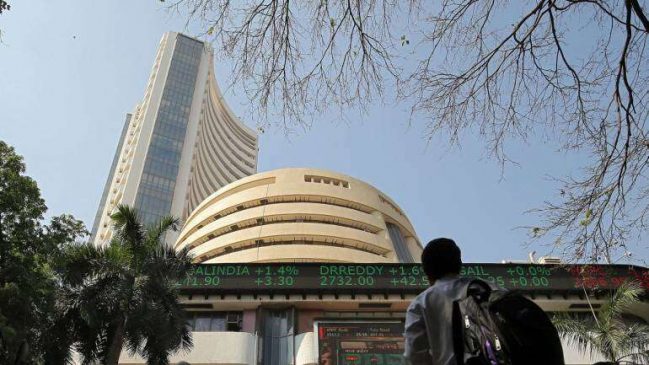

Domestic indices opened flat amid mixed global cues. Key indices Nifty50 hovered flat above 17,700 levels, whereas the S&P BSE Sensex traded flat at 60,188 levels.

Broader indices, which include Nifty Midcap 100 and Nifty Smallcap 100 indices, however, outperformed benchmark indices as they gained up to 0.2 per cent each.

Also Read– Stocks to Watch: TCS, Varun Beverages, HDFC Bank, ONGC, LIC, and Others

Sectorally, Nifty Metal, and Nifty Pharma indices led the charge as they surged up to 0.5 per cent. On the flipside, Nifty IT, and Nifty FMCG indices lost up to 0.1 per cent.

Back home, shares of Tata Consultancy Services (TCS) declined marginally ahead of Q4FY23 results. Brokerages estimate the company to report soft revenue growth over the preceding quarter due to seasonal weakness, however, they foresee margin expansion on lower attrition.

Read More : ITC Shares Hits Fresh All-Time High Ahead of Q4 Results; Should you Buy This FMCG Stock?

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said: “There are some clear trends in the market now. Confidence and stability have returned to the market helping Nifty to rise by 4.5% from the March lows. This, in turn, has been facilitated mainly by the sustained buying by FIIs. The correlation between eight straight days of FII buying and seven straight days of Nifty appreciation is significant. Another trend is that beyond sectoral moves like strength in banking and autos and weakness in IT, there are bouts of activity in individual stocks. This stock-specific action triggered by results/news is likely to gather momentum in the coming days. For equity markets, globally, today’s March US inflation data is crucial since it will determine the Fed response in the May policy meeting. March CPI print in India, too, will be keenly watched.”

Also Read–Gold prices today: 10 grams of 24-carat sold at Rs 60,420; silver at Rs 76,300 per kilo

Global Cues

Asian equities inched lower on Wednesday ahead of a crucial U.S. inflation report that will likely influence the Federal Reserve’s monetary policy path, with markets wagering another hike in interest rates at the central bank’s next meeting.MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.17% lower in choppy trading. Japan’s Nikkei was 0.49% higher, while Australia’s S&P/ASX 200 index rose 0.65%.

Read More:- The global banking crisis and Yes Bank

Tokyo shares opened higher Wednesday following gains on Wall Street, while investors awaited the release of US inflation data later in the day.The benchmark Nikkei 225 index rose 0.23 percent, or 64.86 points, to 27,988.23 in early trade, while the broader Topix index added 0.61 percent, or 13.52 points, to 2,005.37.

Also Read–HDFC Cuts MCLR On Selected Tenures; EMIs To Go Down – Check Revised Loan Rates

Wall Street stocks ended mixed on Tuesday, losing steam late in the session as investors awaited crucial inflation data and the unofficial kick-off of first-quarter reporting season.