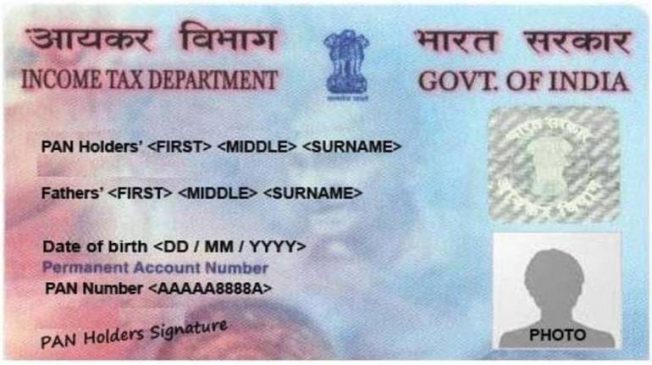

The Income Tax Department has issued a final warning to PAN (Permanent Account Number) holders to link their PAN with their Aadhaar card. According to the public advisory, failure to link PAN with Aadhaar before March 31, 2023, will result in the deactivation of PAN card. Once the PAN becomes inoperative, PAN holders will not be able to initiate financial transactions linked to PAN and even all income tax pending returns will be paused.

The linking of PAN and Aadhaar is mandatory for all Indian citizens except those falling under the exempt category. This includes individuals residing in the States of Assam, Jammu and Kashmir, and Meghalaya, non-residents as per the Income Tax Act, 1961, individuals aged eighty years or more at any time during the previous year, and non-citizens of India.”It is mandatory. Don’t delay, link it today!” The advisory further states that from April 1, 2023, unlinked PANs will be deemed inoperative.

Read More: NPS rule change: What changes for subscribers from April 1, 2023

Last date for linking PAN-Aadhaar

According to The Central Board of Direct Taxes (CBDT), the last date to link PAN with Aadhaar is March 31 2023. People who have not linked the two identity cards can initiate the linking process by visiting the official portal – ncometax.gov.in/iec/foportal. However, people are required to pay a fee of Rs 1000 to initiate the linking process.

If missed the deadline, the PAN card will become inoperative. However, it is not yet clear if the deadline will be further extended or not. However, to check if your PAN card is still valid or not, you can verify it by visiting the Income Tax Department’s official online portal.

Checking the validity of PAN cards is also important, as often the government deactivates PAN cards if an individual is assigned multiple PAN cards or is using duplicate PAN cards.

Read More: Your PAN Card can be misused to secure fake loans! Step-by-step guide to prevent PAN fraud

How to check if PAN card is valid online

To check the validity of your PAN card-

– Visit the Income Tax Department’s e-filing website at incometaxindiaefiling.gov.in/home

– Click on the “Verify Your PAN Details” link on the left-hand side of the page.

– Enter your PAN number in the provided field.

– Enter your full name as mentioned on the PAN card.

– Now enter the captcha code as displayed on the page.

– Click on “Submit”.

– The website will display a message indicating the status of your PAN card, whether it is active or not.

How to check if PAN card is valid through SMS

You can also check the validity of your PAN card by sending an SMS to 567678 or 56161 in the following format: NSDL PAN

– For example, if your PAN number is ABCDE1234F, you will send the following message: NSDL PAN ABCDE1234F

– After sending the SMS, you will receive an SMS with the status of your PAN card, whether it is active or not.

It is important to check the validity of your PAN (Permanent Account Number) card to ensure compliance with income tax laws, carry out financial transactions smoothly, and avoid fraud or misuse of personal information.