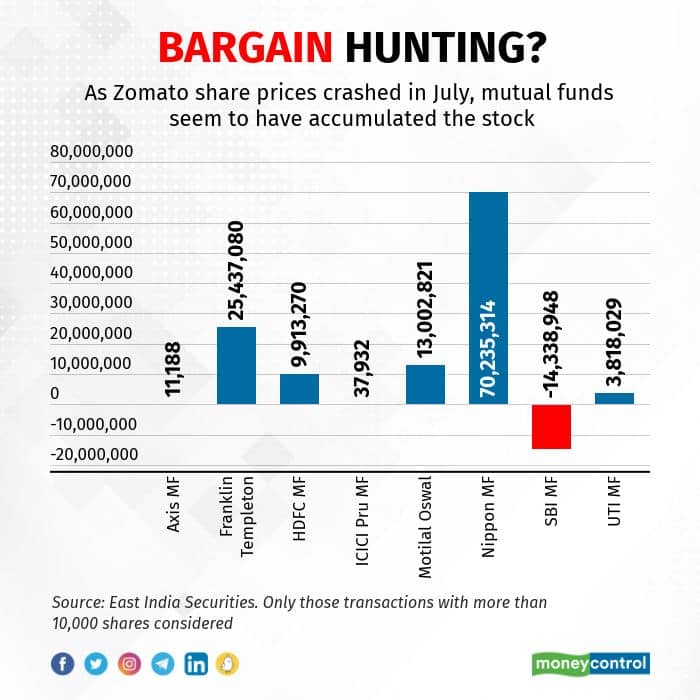

If you were wondering who was buying shares of Zomato in July when everyone seems to have been dumping them, you have an answer now – mutual fund managers.

Mutual fund buying and selling data for July shows, most mutual fund houses who had Zomato in their portfolio earlier chose to accumulate the stock as prices crashed to all time low during the month.

Read More:-Adani Green Energy Gets Provisional Approvals For 2 Projects In Sri Lanka

Managers at Nippon Life Mutual Fund displayed the biggest conviction on the stock as they bought over 7 crore shares of the company during the month. The buying seems to have happened across funds reflecting that money managers at the fund house find Zomato to align with a number of strategies – Smallcap Fund, Retirement Fund, Largecap Fund, Growth Fund, Equity Hybrid Fund and India Value Fund, among others.

In hindsight, their decision to buy seems to be correct as the stock price has risen over 50 percent since hitting a low of Rs 41 on July 26. However, it is still down over 60 percent from its peak last year.

Read More:-After Apple, These Companies END Work From Home, Ask Employees to be in Office. Deets Here

The latest crash in the stock price was triggered by expiry of locked in shares which allowed insiders to dump their stake. Already weak environment for internet stocks globally also aided the fall. However, prices recovered on low-level buying and better than expected June quarter numbers.

In its quarterly earnings, Zomato said its losses halved and it achieved break-even at Ebitda level in the food delivery business. The company now targets to break-even on an overall basis by Q2FY22.

Read More:-Stock Market Update: Sensex Reclaims 60,000 Mark for First Time Since April 5; Nifty Above 17,900

Among others that bought shares of Zomato in bulk in July were Franklin Templeton (2.54 crore shares), Motilal Oswal AMC (1.3 crore), HDFC Mutual Fund (99 lakh) and UTI MF (38 lakh), data collated by East India Securities shows. In most cases, the buying happened across many funds and was not concentrated, showing the consensus view on the stock seems to have changed.

This buying seems to have happened at the same time when many analysts also went bullish on the stock as they believed the crash in prices was an overreaction from the Street. They included those at Jeffries and Kotak Securities.

Read More:-Elon Musk Says He Is Buying Cristiano Ronaldo’s Manchester United

Analysts believe what is the biggest asset for the company is its war chest of $1.6 billion as cash balance which they said was sufficient for the company to chart its growth path.

Kotak said last month that Zomato’s food delivery business was well-poised to grow at a strong pace over the next decade led by attractive market opportunity and strong execution capability. It has a BUY rating with target at Rs 79 per share.

Similarly, Jefferies has a target price of Rs 100 on the stock. They believe the poor sentiment presented a buying opportunity for investors last month. The brokerage house expects profitability in the segment to improve, industry structure to get friendlier and the company to be geared towards preserving cash.

Read More:-DA Hike: THIS state increases Dearness Allowance by 6% for govt employees

However, not everyone seems to have seen value in the stock. SBI Mutual Fund was big seller dumping 1.43 crore shares. However, some of this seems to have happened dud to adjustment in passive funds that follow various indices.