The US Federal Reserve is only one of the many central banks around the world that have started cutting interest rates but the Reserve Bank of India (RBI) may wait a little longer than others.

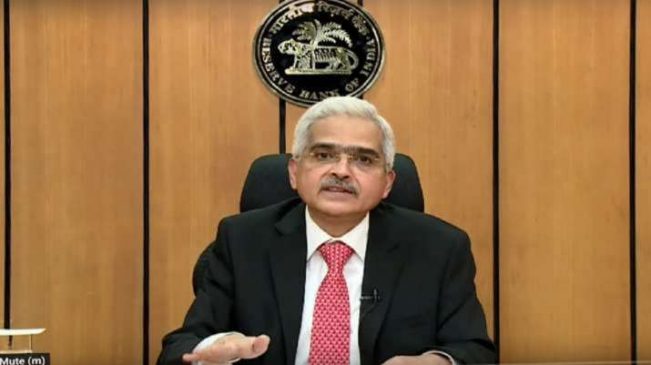

Even before the Fed started, many have already made a case for a rate cut in India citing high real interest rates. But RBI Governor Shaktikanta Das left the interest rates unchanged in August, citing the red hot food inflation chart.

The debate between the two charts is likely to come up again in the next credit policy review from October 7-9. This time, there will also be three new external members in the monetary policy panel, the two charts, and one question: to cut interest rates or not?

Also Read– Atishi to Take Oath at Raj Niwas Today, Set To Become Delhi’s Youngest Chief Minister | Updates

The case for lower interest rates in India

Those who want the RBI to cut rates cite the high real interest rate in India. Real interest rate is the difference between the repo rate and the projected retail inflation for the next year. It currently stands at 2.1% whereas anything between 1.4% and 1.9% is ideal, according to the RBI.

“Very high real rate makes capex unattractive to the corporate,” Jayanth R Varma, external member of the RBI’s monetary policy committee, told CNBC-TV18 in August.

The case for patience

However, RBI Governor Shaktikanta Das would look at real interest rates only after the inflation, particularly food inflation, comes back to the comfort level of 4% sustainably.

So far, the consumer price index has slipped below 4% in July and August 2024. The average retail inflation from April to August is still 4.3%. Food inflation is still above 5%.

Inflation has to sustain at 4% or less for the RBI to consider the real interest rate argument for a rate cut. Or, the economy has to slow down enough for the central bank to ease its stance to boost lending, and therefore, growth.

“At this point, since our base case forecast is that inflation will be going down to about 4.5% sustainably, and growth is going to be 7% this year, it gives little room for RBI to go ahead and cut rates immediately,” Chetan Ahya, Chief Asia Economist at Morgan Stanley told CNBC-TV18.

The premise here is 7% growth is NOT bad enough, and 4.5% inflation IS bad enough.

Read More: US Passport renewal online fee, appointment, application: Big changes announced. Details here

The argument continues

However, Dr Jayanth R Varma, a professor at the Indian Institute of Management, Ahmedabad (IIM-A), and member of the RBI’s rate setting panel has argued that India could indeed grow a lot faster without triggering inflation. “If core trend inflation is downward, it is at 3% core inflation below the target — that means that we are not at potential,” he argued in a conversation with CNBC-TV18 after pushing for a rate cut in the August monetary policy review.

Varma was one of the two people on the panel who disagreed with keeping the repo rate unchanged. He is one of the three people who will be replaced on the panel before the next meeting on October 7.

Even V Anantha Nageswaran, the Chief Economic Advisor at the Finance Ministry, believes RBI cannot change affect food inflation with interest rates and therefore, the central bank must loosen its strings and let lending rates slide.

Economic growth reaches the people on the top of the socio-economic pyramid first. On the other hand, inflation hurts first, and the most, the poorest in any population. The RBI Governor wants to ensure that the price rise is firmly within control before gunning for growth.

Read More: Tirupati Laddu row: Union Health Minister JP Nadda seeks lab report from Andhra CM Chandrababu Naidu

“It is not a question that in the current context, like in July, the inflation came to about 3.6%, that is the revised number, and August has come at 3.7%. So, it is not so much how the inflation is now; we have to look at, for the next six months, for the next one year, what is the outlook on inflation,” Governor Das said in a recent interview.

Bankers know the Governor is not in a hurry. Most economists CNBC-TV18 has spoken to in recent weeks expect the first rate cut in India in December, if not later.

However, the debate may continue to gather momentum in the run up to the next credit policy review from October 7-9.

For more news like this visit Officenewz.com.