A slew of higher-rate, limited period fixed deposit (FD) schemes are set to expire soon.

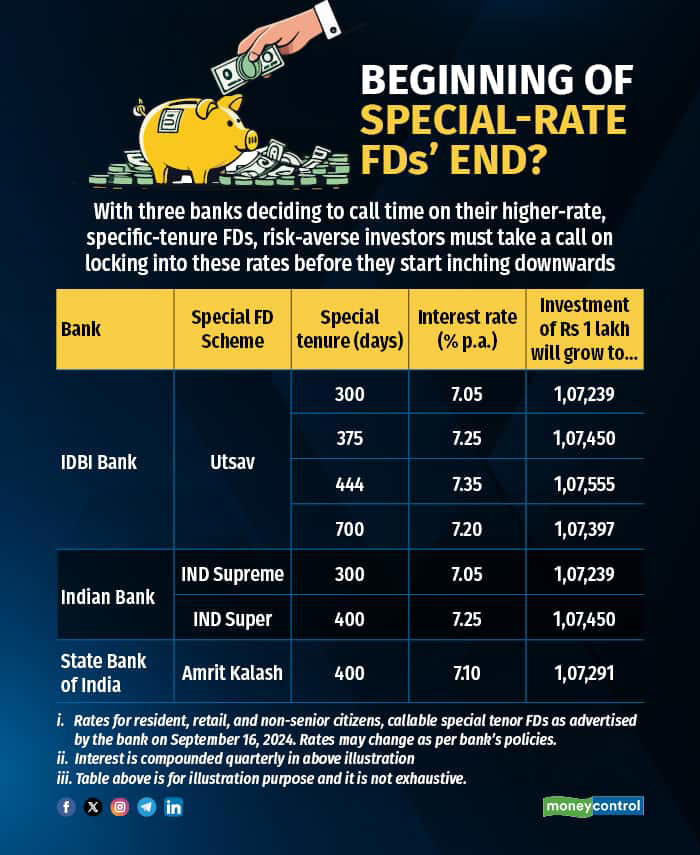

September 30 is the deadline to invest in special-rate, specific tenure fixed deposits offered by three major banks — State Bank of India (SBI), IDBI and Indian Bank. Such schemes offered interest rates ranging from 7.05-7.35 per cent per annum over 300-444-day tenures.

If you are a risk-averse person keen on secure, yet slightly higher returns, you have to take the call on investing now, before the September 30 deadline ends.

Also Read : DDA Extends Payment Deadline For Dwarka 19B Premium Flats To September 30

With the US Fed expected to cut interest rates by at least 25 basis points (bps), the first in 4.5 years since Covid-19, the Reserve Bank of India (RBI) could follow suit in the third or fourth quarter of financial year (FY) 2024-25. Interest rates in India, too, could start sliding down, going forward.

Individuals looking for stable returns could consider locking into these special FDs, which offer higher-than-regular interest rates, now, say financial advisors.

Banks to discontinue special FD schemes

Some banks are offering special tenure FD schemes. Out of these, the three banks have announced their decision to discontinue these schemes from September 30.

IDBI Bank’s Utsav FD scheme offers special FDs with tenures of 300, 375, 444, and 700 days. In this scheme, senior citizens can earn 7.55 to 7.85 per cent interest per annum, and general, NRE (Non-Resident External), and NRO (Non-Resident Ordinary) category investors can earn 7.05 to 7.35 per cent interest per annum depending on the tenure.

Similarly, the SBI’s Amrit Kalash FD scheme with a tenure of 400 days is also offered to general and senior citizens at rate of interest of 7.10 and 7.60 per cent, respectively.

Also Read : Income Tax: How can a middle-class salaried employee optimise for taxes?

Indian Bank’s special FD schemes are IND Supreme and IND Super. The IND Supreme scheme, with a tenure of 300 days, offers a 7.05 per cent interest rate, while the IND Super scheme, with a tenure of 400 days, offers a 7.25 per cent interest rate. These rates apply to both general and NRO investors.

Expectations of lower rates prompting discontinuation

Annual inflation rate in India was 3.65 per cent in August from an upwardly revised 3.6 per cent in July, which was the lowest since August 2019. Despite the marginal rise, it marks the second consecutive month that inflation stayed below the RBI’s target of 4 per cent in five years, amid large base effects in food prices. According to economists, India is slowly heading towards lower interest rate trajectory in coming months, in an alignment with global interest rates.

“We expect RBI to start cutting rates from the last quarter of this year itself. FD interest rates will also naturally align with the benchmark interest rates,” says Gaurav Goel, an investment advisor registered with SEBI (Securities and Exchange Board of India).

Also Read : Cash deposit made easy: Bank of Baroda, Axis Bank roll out UPI-ICD facility

Impact of discontinuation of special FD schemes

Many senior citizens and risk averse investors rely on FD significantly for generating stable returns on their investments. Such investors often settle for lower returns that FDs offer as opposed to riskier assets such as equities as they provide guaranteed returns, barring a credit default by the issuer. Higher-than-normal special FDs had, therefore, been welcomed by individuals with lower risk appetite. “The current series of special FD schemes will end soon, and this would be a definite blow to this set of investor community,” says Goel.

“Senior citizens might feel the pinch as guaranteed higher returns fade, underscoring the need for careful financial planning,” says Akshar Shah, Founder and Chief Executive Officer (CEO) of Fixerra, a banking technology platform.What investors should do?

With the current higher interest rates, locking in your investments ensures you benefit from these special FDs. “Longer tenure FDs provide stable, fixed returns and help in achieving growth and tax benefits, especially for senior citizens,” says Krishan Mishra, CEO, FPSB India, the Indian subsidiary of the US-based Financial Planning Standards Board Ltd. Conversely, it’s also wise to diversify the investment and include some short-term special tenure FDs in your portfolio to maintain liquidity and flexibility in case of changing financial needs for oneself.

“Since the FD schemes generally provide low interest rates, any variant of such schemes should be grabbed with both hands by the fixed-income investors before they are discontinued,” says Goel.

Investors should, however, not be lured only by the higher interest rates. “They should also comprehend ease of operations while investing in FD schemes with the bank,” Goel added.

The end of these special FD schemes may nudge investors towards diversifying, altering the traditional FD landscape. “Explore debt mutual funds and government-backed schemes offering balanced mix of security and returns,” says Shah.

However, if risk-averse investors are investing for the first time in such alternative investment options, then they should carefully understand the risk-reward parameters of these products before investing, according to Goel.