Fixed deposits ensure the safeguarding of a specific amount while providing a consistent income stream. If you possess a lump sum that you do not intend to utilize for a while, placing it in an FD account is a prudent choice.

Individuals planning to invest in bank fixed deposits can take heart from recent developments. Numerous banks have recently increased the interest rates applicable to their fixed deposits. Is now the right time for you to consider investing in fixed deposits?

A fixed deposit (FD) is an appealing choice for those who prefer to avoid risks. It guarantees a fixed interest rate on the principal amount for the entire duration of the deposit, accumulating over time. One of the notable advantages of FDs is their flexible tenure, allowing for the management of multiple deposits with varying durations.

You have the option to establish an FD account with your current bank or any other institution that offers more attractive interest rates. The decision is entirely yours; however, the process may differ, particularly regarding KYC and other documentation requirements if you choose a bank with which you have no prior relationship.

Fixed deposits ensure the safeguarding of a specific amount while providing a consistent income stream. If you possess a lump sum that you do not intend to utilize for a while, placing it in an FD account is a prudent choice. The returns on FDs remain stable, as they are not influenced by market fluctuations, offering a predetermined interest rate for the agreed-upon term.

Read More: SBI launches new design of FASTag that will reduce travel time in highways; how it will help you

Opening an FD account has become a straightforward process. You can either utilize online banking services or visit the nearest branch of your bank. If you choose to open an FD account with the same bank where you maintain a savings account, you can bypass the KYC process and transfer funds seamlessly.

Additionally, senior citizens are entitled to an extra 50 basis points in interest on bank FDs. Therefore, if there are senior citizens in your household, consider opening FDs in their names to benefit from the higher interest rates. FDs can also serve as a valuable resource for urgent financial needs, as the funds can be accessed promptly. While it is possible to secure a loan against your FD, it is advisable to thoroughly review the terms and conditions before proceeding.

You can decide whether the FD amount should be transferred to your savings account or renewed upon maturity. In the latter case, the funds will be reinvested as a fixed deposit. It is important to note that if you choose to withdraw your fixed deposit (FD) prior to its maturity date, you will receive a reduced interest rate, and a penalty will be applied to your FD amount. It is advisable to weigh the advantages and disadvantages carefully and to compare the interest rates offered by various banks for fixed deposits before making a final decision.

Read More: 7th Pay Commission: Central Govt Employees Likely To Get 3-4% DA Hike On THIS Date, Check Details

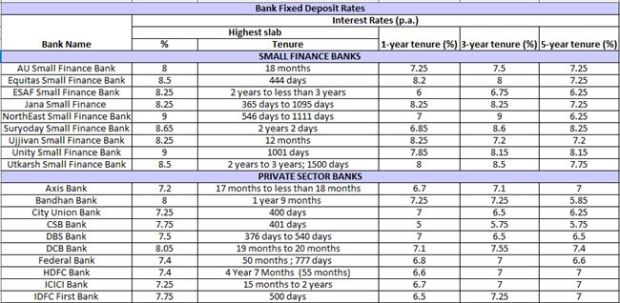

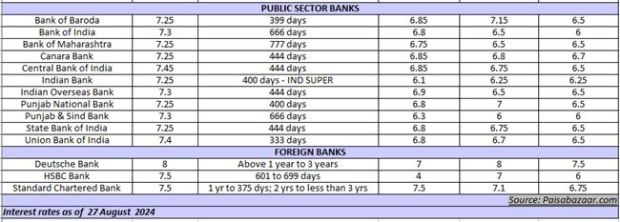

Given below is a list of more than 40 banks – including SBI, HDFC Bank, ICICI Bank, Axis Bank, BoI, PNB, Union Bank, Bank of Baroda, and Kotak Bank, among others — that provide competitive interest rates on fixed deposits. You may compare the interest rates and terms ranging from 1 to 5 years and select an option that best suits your needs.

India’s Top Banks with Highest Fixed Deposit Rates