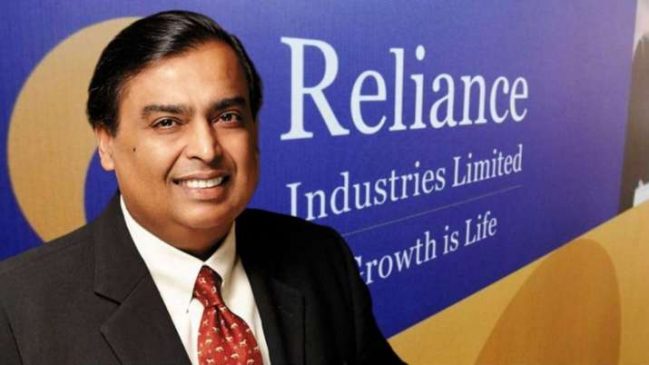

RIL Chairman Mukesh Ambani will address shareholders at the meeting at 2 pm on Thursday.

Reliance Industries Ltd (RIL) is set to conduct its 47th annual general meeting (AGM) on August 29. RIL Chairman Mukesh Ambani will address shareholders at the meeting at 2 pm on Thursday. Around 3.5 million shareholders are eagerly anticipating insights into how India’s largest conglomerate plans to capitalise on emerging opportunities and drive growth.

According to JM Financial, shareholders will closely watch timelines for potential public listings of Reliance’s digital and retail units, as well as updates on the progress of new energy projects. Here are five key areas to be watched out for this year:

Reliance Retail and Reliance Jio IPOs

Investors will be keenly observing for any concrete plans or dates regarding the initial public offerings of Reliance Jio or Reliance Retail. Back in the 2019 AGM, the management had announced plans to list both businesses within five years.

Since then, investors have been eagerly awaiting a timeline for the announcement of these listings. According to analysts at global brokerage firm Jefferies, Jio could go public in 2025, with an estimated valuation of around $112 billion.

Strategic Stake Sale in O2C Business

Investors will also be watching for any potential strategic stake sales in Reliance’s oil-to-chemicals (O2C) segment, according to a report by JM Financial Services. Details on potential buyers, transaction value, and the strategic benefits of such a sale will be closely monitored.

Read More: Zomato’s new ticketing feature: Buy now, resell later—because plans change

Progress on New Energy Projects

There will be significant interest in updates regarding ongoing projects in the new energy sector. Investors will look for specific timelines for project commissioning and assessments of potential earnings from these ventures. For FY24, RIL has allocated $1 billion in capital expenditures for its solar manufacturing business. The AGM is expected to provide more detailed insights into these developments.

Reliance is constructing a large green energy complex in Jamnagar, featuring giga factories for solar PV, energy storage, electrolysers, fuel cells, and power electronics. However, progress appears slow, according to analysts. Compared to the initial $10 billion investment plan for the first three years, only $2 billion has been invested.

Read More: THIS State Govt Announces Waiver Of Old Electricity Bills For A Particular Section Of Society

5G Monetisation Plans

The AGM is expected to provide insights into Reliance Jio’s strategies for monetising its 5G network. This includes plans for leveraging 5G technology to drive revenue growth, potential partnerships, and how the rollout might impact overall financial performance.

Reliance Jio’s 5G rollout is gaining momentum, and analysts expect updates on subscriber growth, revenue strategies, and international expansion plans in the AGM to enhance RIL stock’s appeal.

Succession Plan

Further details on Reliance Industries’ succession plans are of interest. Investors will be looking for updates on leadership transitions, key appointments, and how the succession strategy aligns with the company’s long-term vision. RIL Chairman Mukesh Ambani revealed a succession blueprint in 2022, with Isha Ambani leading retail, Akash leading Jio, and Anant overseeing the energy business.

At last year’s AGM, Mukesh Ambani announced that he would retain the position of the company’s chairman and managing director for the next five years. This year, investors will be closely watching for further updates on the leadership transition.

DISCLAIMER:Network18 and TV18 – the companies that operate news18.com – are controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.