Referring to the country’s experience, Das said DPI has enabled India to achieve, in less than a decade, levels of financial inclusion that would have otherwise taken several decades.

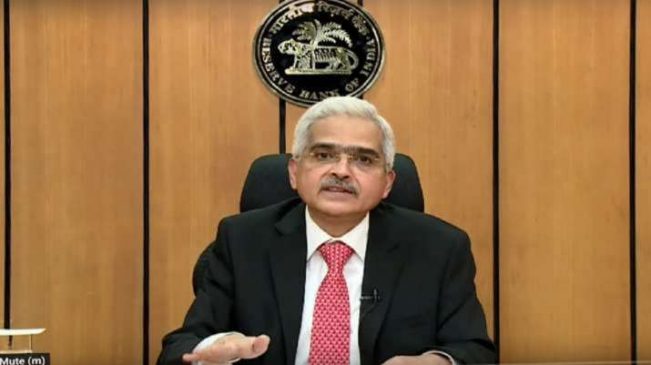

Reserve Bank of India Governor Shaktikanta Das on Monday said that the central bank’s new Unified Lending Interface (ULI) platform aimed at “enabling frictionless credit” will be launched soon. The platform is currently in the pilot stage started in August last year.

Also Read– Top CD Rates Today: August 19 — Earn Up To 5.75% APY

Addressing the RBI@90 Global Conference on Digital Public Infrastructure and Emerging Technologies; Das recalled various initiatives being taken by the RBI with regard to Unified Lending Interface (ULI) and Central Bank Digital Currency (CBDC).

Continuing on this journey of digitalisation of banking services, last year we launched the pilot of a technology platform which enables frictionless credit. From now on, we propose to call it the Unified Lending Interface (ULI), he added.

The Governor talked about Indias advancements in the field of digitalisation of the financial services. He further said Unified Payments Interface (UPI), a real-time payment system, has emerged as a robust, cost-effective and portable retail payment system and is attracting active interest across the globe.

Also Read– RBI To Launch Unified Lending Interface To Reduce Credit Gap In MSME, Agri Sectors

RBI Governor On Central Bank’s UPI System

Reserve Bank Governor Shaktikanta Das on Monday said the central bank is constantly working on policies, systems, and platforms to make the country’s financial sector strong, nimble and customer centric.

The Governor also said that the UPI system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances and "a beginning can be made with small value personal remittances as it can be quickly implemented.

According to the Economic Survey tabled in Parliament in July, remittances to India, the second largest source of external financing after service exports, are projected to grow at 3.7 per cent to USD 124 billion in 2024 and at 4 per cent to reach USD 129 billion in 2025.

Also Read– 5 Major Bank Account Scams and How to Avoid Them

RBI Governor Shaktikanta Das @90 Global Conference

Das said the Reserve Bank of India is looking forward to the journey towards RBI@100 with considerable optimism.

We are constantly working on devising policies, approaches, systems and platforms that will make our financial sector stronger, nimble and customer centric, he said.

Speaking on the theme of DPI and emerging technologies, he said over the last decade, the traditional banking system has undergone an unprecedented technological transformation.

Also Read– What should I do if I find someone’s credit card?

By all indications, this process is likely to become even more intense in the coming years, he added.

He said DPI spurs market innovation by reducing transaction costs, democratising access, maintaining competition through interoperability, and attracting private capital.