Fixed deposits for senior citizens are tailored to address the unique needs of this demographic, offering elevated interest rates along with various additional benefits.

Despite so many investment options available in the market today, fixed deposits still remain the preferred investment choice for risk-averse individuals, particularly senior citizens. The appeal of guaranteed returns, preferential rates of up to 0.5%, mandatory savings, high liquidity, and the simplicity of the investment process are key factors contributing to this preference.

Read More: Federal Bank announces special fixed deposit rates on specific tenors – Check new FD rates

In the context of increased economic uncertainty and market fluctuations, many senior citizens prefer to avoid market-linked investments in order to preserve and enhance their retirement savings by investing in fixed deposits. Indeed, numerous senior citizen depositors rely on the regular interest payments from their non-cumulative fixed deposits, which are available on a monthly, quarterly, semi-annual, or annual basis, to cover their daily expenses.

Additionally, fixed deposits serve as effective instruments for establishing emergency funds, as they not only allow for capital growth but can also be liquidated prior to maturity to address urgent financial needs, albeit with a potential loss of up to 1% in interest income.

To achieve greater rewards without incurring investment risks, senior citizen depositors may consider employing the FD laddering strategy. This approach allows them to divide their total investment into several fixed deposits (FDs) with varying maturity periods, enabling them to reinvest the funds as necessary and establish a continuous investment cycle.

Read More: Highest Interest Rate On FD: HDFC, SBI, Axis Bank, ICICI Bank, Canara Bank, Calculate Latest Rates

For instance, if a depositor possesses Rs. 5 lakh, rather than investing the entire amount in a single FD, they could allocate the funds into five separate FDs of Rs. 1 lakh each, with maturities of 1 year, 2 years, 3 years, 4 years, and 5 years, respectively. This method not only positions them to take advantage of potentially higher interest rates in the future but also reduces the need to prematurely withdraw an FD to address urgent financial needs, thereby preserving interest income.

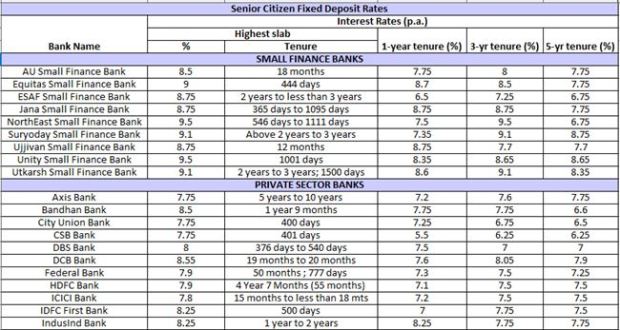

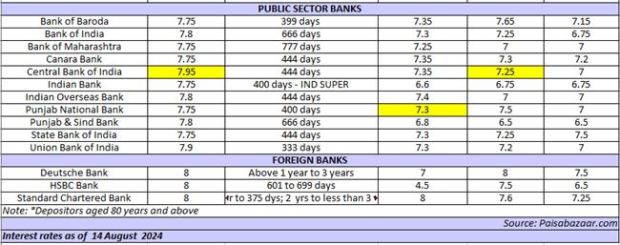

Therefore, for those seeking optimal FD options for senior citizens, the following are the current interest rates provided by more than 40 largest banks – including the State Bank on India, PNB, ICICI Bank, HDFC Bank, Axis Bank, BoI, Union Bank, Indian Bank, among others — in the country, based on their total asset size, for tenures of up to 5 years. Review these rates to select the options that align best with your financial goals.

Read More: RBL Bank Launches Special Edition Of Vijay Fixed Deposits, Offers Upto 8.85% Interest Rates