Hindenburg Research’s new allegations: The new allegations came after a year Hindenburg published its report on Adani Group.

Read More: Bumper Debut: Afcom Holdings lists at ₹108, 90% premium to IPO price

In the latest tweet from the US short-seller Hindenburg Research has levelled allegations against SEBI Chairperson Madhabi Puri Buch.

“Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal,” the tweet read.

Read More: IPO Calendar: 5 new issues, 3 listings investors need to watch out for next week

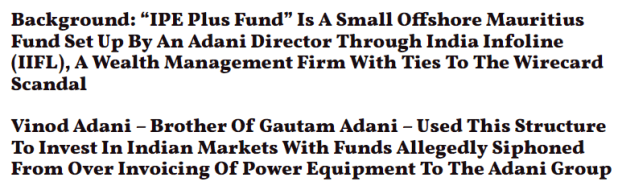

In one complex structure, a Vinod Adani controlled company had invested in “Global Dynamic Opportunities Fund” (“GDOF”) in Bermuda, a British overseas territory and tax haven, which then invested in IPE Plus Fund 1, a fund registered in Mauritius, another tax haven, said Hindenburg citing documents recieved through a whistleblower.

“Madhabi Buch and her husband Dhaval Buch first appear to have opened their account with IPE Plus Fund 1 on June 5th, 2015 in Singapore, per whistleblower documents,” Hindenburg alleged citing documents.

Read More: Upcoming IPO: BR Goyal Infrastructure files DRHP for BSE SME IPO. Details here

By the time the copy was published, Financial Express.com has emailed SEBI for their response on the development.

Earlier on August 10, the short-seller research firm tweeted that something big is coming India’s way.