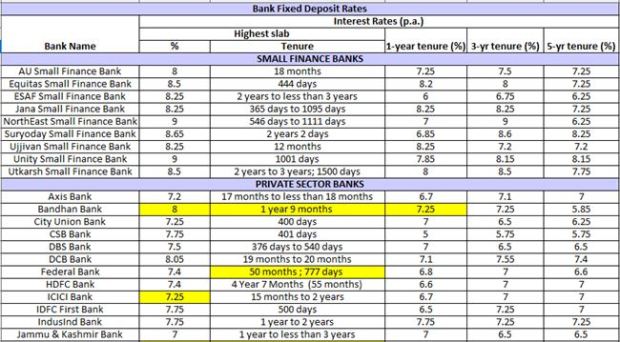

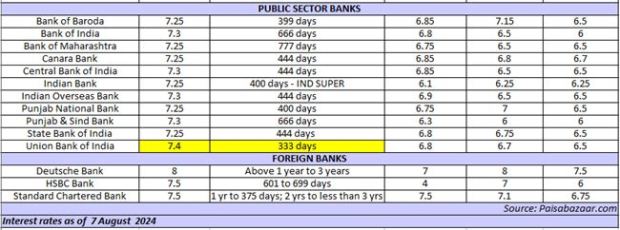

The table presented here includes more than 40 banks, including State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, PNB, Bank of India, Union Bank, Kotak Mahindra Bank, and Yes Bank, which provide interest rates reaching as high as 9% on fixed deposits.

Fixed deposits (FDs) rank among the most favored investment options in India, especially for those who prefer to avoid risk. Nevertheless, selecting the appropriate bank for your fixed deposit investment can prove to be a daunting task. Many individuals tend to opt for their current banks to place their funds in FDs, but determining the optimal choice requires careful consideration.

The decision to invest in an FD is influenced by various factors, including the interest rate, the security of the investment, and individual preferences. Below are several recommendations to assist you in making a more informed decision:

FD Interest Rate

Generally, smaller financial institutions tend to provide more competitive interest rates compared to their larger counterparts, as they prioritize the acquisition of deposits. Nevertheless, it is crucial to evaluate the interest rates presented by various banks and ascertain whether the elevated rate from a smaller bank justifies the associated risks.

Safety

A key consideration when investing in fixed deposits is the security of your investment. Typically, larger banks are perceived as more secure than smaller ones, owing to their greater size and financial stability. These larger institutions are better equipped to endure economic recessions and financial challenges than smaller banks.

Read More: Bank of Baroda, UCO, Canara Bank marginally hike MCLR: Check details

Personal preferences

Your individual preferences and financial objectives will significantly influence your decision-making process. Should you prioritize the convenience and accessibility offered by a larger financial institution, you might choose to invest with a major bank. Conversely, if your aim is to support local enterprises or maintain a personal connection with a smaller bank, you may opt to invest in a small bank.

Ultimately, there is no definitive answer regarding whether one should invest in small or large banks for fixed deposits. It is essential to consider factors such as interest rates, security, and individual preferences prior to making a decision. Selecting a bank that corresponds with your financial objectives and priorities is crucial.

The table presented below includes more than 40 banks, including State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, PNB, Bank of India, Union Bank, Kotak Mahindra Bank, and Yes Bank, which provide interest rates reaching as high as 9% on fixed deposits. By evaluating these rates, you can make a well-informed choice regarding your investment based on your specific requirements and various factors.

Read More: GST on health and life insurance: How much do tax rates impact your premiums? check here