A high 18% GST on life and health insurance premiums in a country like India, where insurance penetration is low, defies logic. Also, there is no social security net in India and government medical facilities are rickety. Why does the government charge 18% tax on insurance products despite robust GST collections?

This is one pinch we all feel every time we pay the premium for our life and health insurance policies. The prohibitive 18% Goods and Services Tax (GST) adds to the high premium that insurers are charging. In a country like India, where insurance penetration is low, the high tax rate discourages people from getting insured or opting for higher cover.

Read More:- GST Collections Rise 10.3% In July 2024: Check State-Wise Growth Of GST Revenues

This over-taxing of the people comes even as the government has been raking in higher GST collections month after month.

It was Union Road Transport and Highways Minister Nitin Gadkari who recently stirred the hornet’s nest by seeking the elimination of the 18% GST on life and health insurance premiums.

In a letter to Finance Minister Nirmala Sitharaman, Gadkari said taxing these premiums equates to “taxing life’s uncertainties“ and hinders the growth of the insurance sector.

In a country where there is no social security net and government medical infrastructure is rickety, the high 18% GST on life and health insurance premiums defies logic.

The GST regime came into effect on July 1, 2017. For years now, the GST Council has been talking about reviewing the rates, but has not made any move towards it, despite the high collections.

Read More: Adani Super app launches digital lending trials with fintechs and NBFCs: What we know

In July 2024, the government’s GST collection stood at Rs 1,82,075 crore, a 10.3% year-on-year increase. This is reported to be the third-highest monthly collection since the GST regime kicked in seven years ago.

Not only Nitin Gadkari, even the Standing Committee on Finance, headed by Jayant Sinha, recommended that the GST rate on insurance products, especially term and health, be reduced.

In 2021-22, insurance penetration (percentage of insurance premium to GDP) in India was 4.2% as compared to the global average of 7%, the standing committee report said. It noted that there was a need to create mass awareness about the need and benefits of having insurance protection and diverse insurance products.

The high rate of GST results in a high premium burden, which acts as a deterrent to getting insurance policies, the committee’s report, submitted in February, observed.

Read More: Gold Rates Today: Check Top City Wise Gold Prices In India On 2nd August, 2024

“India’s insurance penetration, at 30%, remains relatively low compared to developed countries, like the US, where it is over 90%,” Rupinderjit Singh, Senior Vice President with ACKO insurance company, tells IndiaToday.In.

The low penetration and high insurance cost ultimately result in high out-of-pocket expenses for medical emergencies.

“According to the Global Interfaith Council, India has 62% out-of-pocket expenditure compared to 10% in the US,” says Singh, adding, “Healthcare remains one of the primary reasons for a family to end up back in poverty.”

WHY GOVERNMENT CHARGES 18% GST ON INSURANCE PREMIUMS

“The government’s logic of imposing GST can be seen from the lens of an avenue to generate revenue,” ACKO’s Singh tells IndiaToday.In.

Read More: Petrol, Diesel Fresh Prices Announced: Check Rates In Your City On August 2

He explains how the government needs ways to broaden the tax base as just 2 crore Indians pay income tax.

The GST regime aims to create a uniform structure across goods and services. Insurance is considered a financial service and charged at an 18% GST rate.

Most experts think that the GST rates should be rationalised for different segments if the tax isn’t done away with completely.

“In our opinion, there should not be a complete removal of taxes. Instead, the tax should be linked to the annual premium and the type of insurance product,” says Sandeep Katiyar, Co-Founder and CFO of financial services platform Finhaat.

“Taxes on premiums for individuals at the bottom of the economic pyramid or senior citizens should be eliminated. For other income segments, the tax should be lower on pure-term plans and medical insurance premiums,” Katiyar tells IndiaToday.In.

That the government gives tax exemption under 80C for life and 80D for health insurance is no defence for the exorbitant rate charged on insurance premiums.

Read More: Adani Ports Q1 Results: Profit rises by 47.2% YoY, revenue at Rs 6,956.32 crore

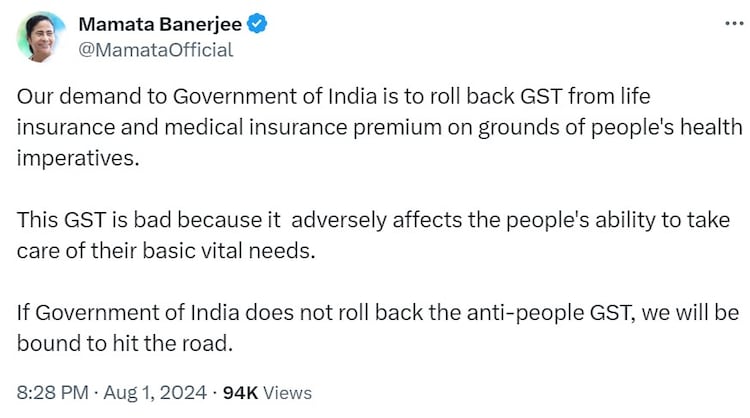

On Thursday, West Bengal Chief Minister and Trinamool Congress chief Mamata Banerjee too demanded the Centre to roll back the GST on life and medical insurance premiums.

“This GST is bad because it adversely affects people’s ability to take care of their basic vital needs,” Mamata said.

INSURANCE PENETRATION DIPS, PREMIUM COLLECTION RISES

The annual report by the Insurance Regulatory and Development Authority (IRDAI), India’s insurance regulator, said there had been a 2.21% fall in the number of new life insurance policies issued in 2022-23 as against the previous year.

The IRDAI report shows that while insurance penetration fell, the premium payout by people went up.

Read More: Zomato to launch new app called District for ‘going-out’ business: What is it?

IRDAI quotes a report by Swiss Re Sigma to say that insurance penetration of the life insurance sector reduced from 3.2% in 2021-22 to 3% in 2022-23. For the non-life insurance sector, penetration stagnated at 1%.

Though penetration dipped, the IRDAI report said life insurance premium collection went up 13% to Rs 7.83 lakh crore in 2022-23 from a year ago.

Almost 53% of the premium income of the life insurance industry is from renewal premiums, while 47% is from new business premiums. This too could be a marker of fewer people going in for insurance cover.

PEOPLE GOING FOR SMALLER COVER DUE TO HIGHER COST

What high premiums and the additional 18% GST is doing is that it is limiting people from going for higher insurance covers.

“Many users do settle for a smaller cover due to high premiums. In India, the premium cost is a crucial factor when selecting a health insurance plan,” says Rupinderjit Singh of ACKO.

Read More: Zomato Posts 126% Net Profit Growth At Rs 253 Crore In Q1 Riding On Blinkit

“Customers often have limited budgets, which leads them to choose lower cover plans that fit within their financial constraints, even if it means reduced coverage,” adds Singh.

He says the exemption of GST on health insurance will be a big boost and help get sufficient covers at affordable prices.

Premium payment capacity is directly linked to disposable income, which is limited for the poor and lower-middle-class segments, says Sandeep Katiyar of Finhaat. “If premiums decrease due to lower taxes, individuals in these groups will be able to obtain higher coverage,” he adds.

Read More: Emami Q1 Results: Net Profit Rises 10% YoY to Rs 150.6 Crore, Revenue Up 9.73%

Therefore, it is high time that the GST Council moves to rationalise, if not eliminate, the 18% GST rates on life and health insurance premiums. This will boost insurance penetration in India and help people go in for higher coverage.