One of the highlights of this year’s Budget is the proposed modification of the tax slabs under the new regime, which has been a focus area of the government.

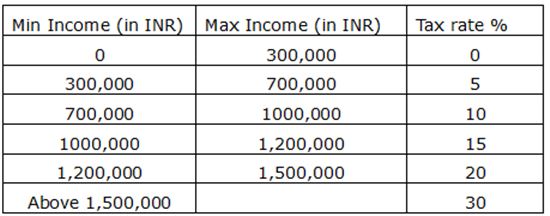

One of the highlights of this year’s Budget is the proposed modification of the tax slabs under the new regime, which has been a focus area of the government. In the new tax regime, the income tax rates are set to undergo the following changes:

Also Read– Digital payment: RBI’s new rules on payment methods of two-factor authentication for more safety

Moreover, the standard deduction for salaried employees is proposed to increase from Rs 50,000 to Rs 75,000, providing further relief to taxpayers. These revisions are expected to provide tax savings up to Rs 17,500 for a salaried taxpayer under the new regime.

The Budget further proposes an increase in deduction related to family pension for pensioners opting for the New Tax Regime, raising it from Rs 15,000 to Rs 25,000. This is aimed at improving the financial well-being of pensioners and providing them with greater disposable incomes.

Read More: 7th Pay Commission: Central Govt Employees Likely To Get 3% DA Hike in September, Check Details

Further, in a bid to enhance social security benefits, the Budget proposes an increase in the deduction of employer’s contribution towards the National Pension System (NPS) from 10% to 14% of the employee’s salary for those opting for the new tax regime. This move is expected to encourage more taxpayers to opt for the new tax regime.

The Budget also aims to rationalize the taxation of capital gains, proposing a simplified structure. The holding period has been limited to two periods only – 12 months and 24 months – to determine if an asset is a long-term or a short-term capital asset.

Read More: PNB Hikes Lending Rate By 5 Bps Across Tenors, Loans To Get Costlier

Further, long-term gains on all financial and non-financial assets will now attract a uniform tax rate of 12.5%. Hence, the tax rate for long-term capital gains on STT paid listed securities and units of equity-oriented funds has increased from 10% to 12.5%, above Rs 125,000 (as against Rs 100,000 under the current provisions); however, the tax rate for long term capital gains on all other assets has been reduced from 20% to 12.5%. Moreover, the benefit of indexation, which was earlier available on long term capital assets, has been proposed to be abolished.

While for listed bonds and debentures, the rate shall be reduced to 12.5%, capital gains on unlisted debentures and unlisted bonds shall still be taxed at applicable slab rates, irrespective of whether it is a short-term or long-term gain.

Concurrently, short-term capital gains (STCG) on listed equity shares and units of equity-oriented mutual funds will see an increase in the tax rate from the existing 15% to 20%.

To ease the cashflow for salaried taxpayers, it has been proposed that the tax collected at source, or any other deduction of tax, be allowed while arriving at the remaining tax liability by employers. This is a welcome move which shall result in reducing the claims for refund while filing the tax return.

Similarly, positive changes have been proposed in the Budget to provide relief to taxpayers under the Black Money Law and in reducing the time for issuing notices for reassessment.

The above changes made by the Hon’ble FM aim to make the new tax regime more attractive, which is in line with the thinking of the government. On the contrary, the increase in the capital gains rate for STT paid listed securities and units of equity-oriented funds may dampen the spirit of investors.

Also Read– Sovereign Gold Bonds: Investors would fetch 12% returns from next set of redemption on Aug 5

Overall, the Budget seems to be moving in the direction of simplifying the tax laws, to make life easer for the taxpayers.

For more news like this visit Officenewz.com