Interest rates significantly influence the returns for FD investors, making it essential to carefully assess this aspect. Additionally, selecting the appropriate tenor based on financial goals is vital.

Fixed deposits (FDs) have always been a popular choice for investors looking for stability, security, and consistent returns. Providing a safe and reliable option for wealth preservation and growth, fixed deposits are a fundamental component of many investment portfolios.

When opening an FD account, individuals often face confusion regarding the initial investment amount, choice of institution, tenor selection, and optimal timing for investment. A crucial factor to consider when investing in FDs is the desire for higher interest rates, as this directly impacts the final maturity amount.

Interest rates significantly influence the returns for FD investors, making it essential to carefully assess this aspect. Additionally, selecting the appropriate tenor based on financial goals is vital.

While Fixed Deposits provide stability and security, there are several key factors to consider. To begin with, FD interest rates are not fixed and can change, so it is crucial to keep an eye on rate fluctuations and take advantage of favorable opportunities. Additionally, it is wise to diversify your investments to reduce risk and maximize returns. Lastly, take into account inflation and tax implications when evaluating the overall returns on your FD investments.

In summary, Fixed Deposits continue to be a fundamental aspect of conservative investing in India, providing stability, security, and consistent returns. By recognizing the advantages of FDs and strategically timing your investments, you can effectively increase your wealth. Whether your goal is to generate passive income, save for a specific objective, or build a retirement fund, FDs offer a dependable path to achieving your financial goals.

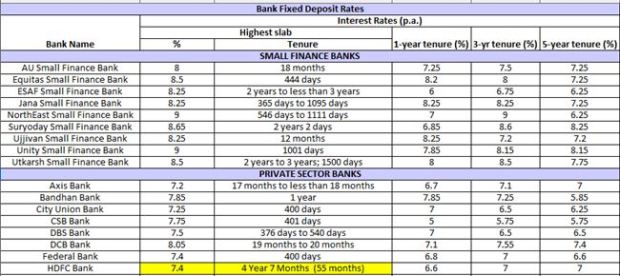

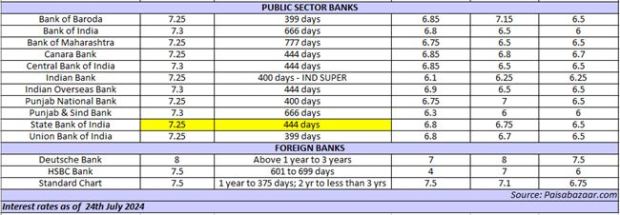

The list provided in the table comprises over 40 banks, such as SBI, PNB, BoI, HDFC Bank, ICICI Bank, and Axis Bank, that offer interest rates of up to 9% on fixed deposits. By comparing these rates, you can make an informed decision on where to invest according to your needs and various considerations.

Read More: Up to 8% FD rate: SBI Amrit Vrishti FD interest rate vs other big banks’ 400-day fixed deposits