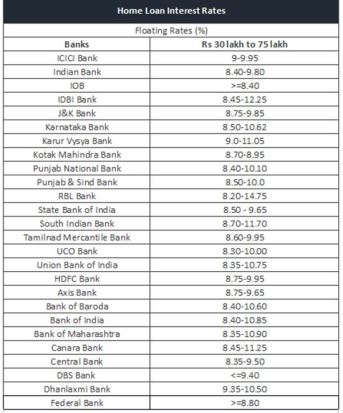

Securing a home loan at a lower interest rate requires comparing the rates of various financial institutions to find the best fit for your needs.

Interest rates are a crucial factor in determining the amount we can borrow and the budget we can allocate for purchasing our new home. Buying a home involves various factors to consider, with budget being one of the most important aspects. A higher budget allows us to afford a house that meets our preferences, while a shortage of funds can make it difficult to purchase a home that fulfills all the criteria on our wish list.

Securing a home loan at a lower interest rate requires comparing the rates of various financial institutions to find the best fit for your needs. Below are some guidelines to help you obtain the most affordable home loan offers.

Read More: Capital Gains Tax On Mutual Fund Earnings: How Much Tax You Will Pay On Rs 5 Lakh?

Compare Lenders

The first step in finding the cheapest home loan is to compare the interest rates offered by different banks and financial institutions. Utilize online comparison tools and websites to get an overview of the current rates and offers. Banks often have competitive rates, but smaller banks and NBFCs might offer lower rates to lure customers.

Look for Special Schemes

Many lenders provide special schemes with lower interest rates for women borrowers, government employees, and first-time home buyers. These schemes can significantly reduce your borrowing cost. For instance, some banks offer concessional rates for women applicants and defense personnels.

Read More: Budget 2024: These 4 TDS changes announced by Nirmala Sitharaman will impact you

Maintain a High Credit Score

Your credit score plays a crucial role in determining the interest rate on your home loan. A score above 750 is considered good and increases your chances of getting a loan at a lower interest rate. Regularly check your credit report for errors and pay off existing debts to improve your score.

Shorter Tenure and Negotiation with Lenders

While a longer loan tenure might reduce your monthly EMIs, it can increase the overall interest paid. Choosing a shorter tenure can help you get a lower interest rate and save on interest costs over the life of the loan.

Don’t hesitate to negotiate with your lender for a better deal, especially if you have a good credit history and a stable income. Sometimes, lenders are willing to offer lower rates to retain or attract customers.

Read More: Physical gold vs SGBs: Which generated more wealth for investors since launch of gold bonds?

Consider Floating Rate Loans

Floating rate loans are typically cheaper than fixed-rate loans, especially when the interest rates in the economy are expected to fall. If you anticipate a decrease in rates, a floating rate loan could be more cost-effective.

Check Pre-Approved Loans

Pre-approved loans come with a quicker approval process and often better terms. If your bank offers a pre-approved loan, it’s worth considering as it can save both time and money.

By following these strategies, you can increase your chances of securing a home loan at the lowest possible interest rate, reducing the financial burden significantly.

Note: Rates that vary with tenures or credit scores within the specified loan amounts are indicated as a range. Data taken from respective bank’s website as on July 12, 2024. Compiled by BankBazaar.com.