APermanent Account Number (PAN) is a crucial identity document required for Income Tax filings. It is essential to ensure that details such as name, date of birth, photograph, signature, father’s name, Aadhaar, gender, mobile number, email ID, address, or contact information are accurate and up to date. If any of these details are incorrect or have changed, it is advisable to rectify and update the PAN card promptly.

Change PAN card details: Online and offline methods

You have the option to update PAN card details online through either the NSDL e-Gov website or the UTIITSL website. If you initially applied for a PAN card through the NSDL e-Gov website, you should proceed to update PAN details on the same website. Similarly, if your PAN card application was made through the UTIITSL website, you should update the PAN card details on the UTIITSL website.

Read More: Cyclone Remal Big Update: Indian Railways Cancelled THESE Trains, Check IRCTC Full List Here

Update PAN card on the NSDL e-Gov portal

Step 1: Begin by accessing the NSDL e-Gov portal.

Step 2: Navigate to the ‘Services’ tab and choose ‘PAN’ from the dropdown menu.

Step 3: Scroll down until you find the section titled ‘Change/Correction in PAN Data’. Click on ‘Apply’ from the provided options.

Step 4: Complete the Online PAN Application form with the necessary details:

Application type: Changes or Correction in existing PAN Data/Reprint of PAN Card

Category: Select the appropriate category from the dropdown menu.

Other personal details: Fill in required information such as Title, Last Name/Surname, First Name, Middle Name, Date of Birth/Incorporation/Formation, Email ID, Mobile Number, Citizenship (Indian or non-Indian), PAN number.

Enter the ‘Captcha Code’ and click on ‘Submit’.

Step 5: Upon successful registration, you will receive a Token Number via email. This token number allows access to the draft version of the form if the session times out. Click on ‘Continue with PAN Application Form’.

Step 6: Three options will be displayed:

Submit digitally through e-KYC & e-Sign (Paperless)

Submit scanned images through e-Sign

Forward application documents physically

To complete the process online via Aadhaar OTP, choose the first option ‘Submit digitally through e-KYC & e-Sign (Paperless)’.

Read More: Planning to invest in a fixed deposit for 1 year: Top 5 banks offering highest interest rates

Step 7: Indicate whether you require a new physical copy of the updated PAN card. Nominal charges may apply.

Step 8: Provide the last four digits of your Aadhaar number.

Step 9: Update the required details and select the relevant correction or update. Click ‘Next’ to proceed to the ‘Contact and other details’ page.

Step 10: Input the new address, updated mobile number, or email address and proceed.

Step 11: Attach proof documents corresponding to the updated details along with a copy of PAN.

Step 12: Complete the declaration section by mentioning your name, selecting ‘Himself/herself’ to confirm self-submission, and entering your place of residence.

Step 13: Attach a copy of your photograph and signature, ensuring they meet the specified specifications and sizes. Click ‘Submit’ upon completion.

Step 14: Review the form preview and enter the first eight digits of your Aadhaar Number to verify the accuracy of the provided details.

Step 15: Proceed to the payment page after submitting the PAN card correction form. Payment can be made through various payment gateways. Upon successful payment, a payment receipt will be issued.

Step 16: To finalise the PAN card update/correction process, click ‘continue’. Complete the KYC process by accepting the terms and conditions and clicking on ‘Authenticate’.

Step 17: An OTP will be generated and sent to your Aadhaar Registered mobile number. Enter the OTP to submit the online PAN application form.

Step 18: Click on ‘continue’ with eSign on the next screen.

Step 19: Accept the terms and conditions, enter your Aadhaar number, and click on ‘Send OTP’.

Step 20: Enter the OTP sent to your Aadhaar Registered mobile number for verification. Download the acknowledgement form. The password to open this file is your date of birth in the format DD/MM/YYYY.

Please note: If you select the ‘Forward application documents physically’ option in Step 6, print out the acknowledgement and mail it along with the required documents to the following address:

Income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune – 411045

Read More: SBI Warns Customers Of Fake WhatsApp Messages, SMS; Details Here

Steps to update PAN card on UTIITSL portal

Step 1: Begin by accessing the UTIITSL website.

Step 2: Click on the ‘Click to Apply’ option under the ‘Change/Correction in PAN Card’ tab.

Step 3: Choose the ‘Apply for Change/Correction in PAN card details’ tab.

Step 4: Select the mode of document submission, enter your PAN number, choose the PAN card mode, and click the ‘Submit’ button.

Step 5: Upon successful registration, you will receive a reference number. Click on ‘OK’.

Step 6: Ensure to check the fields requiring updates or corrections. Enter the accurate personal details and proceed by clicking on ‘Next Step’.

Step 7: The address will be updated based on your Aadhaar card. Input your contact details and proceed to the next step.

Step 8: Enter the PAN number and complete the verification process by clicking the ‘Next Step’ button.

Step 9: Upload the necessary documents and click on the ‘Submit’ button.

Step 10: Review the details on the form and proceed to make the payment by clicking on the ‘Make Payment’ button.

Step 11: Select the preferred online payment mode and complete the payment process. A success message will be displayed upon successful payment. It is advisable to print out the form.

Typically, PAN correction processes take around 15 days. You will receive a notification via text message on your registered mobile number once your PAN card is dispatched via post.

Please Note: If you opt for the ‘Physical (Forward Application with documents physically)’ option in Step 4, you will need to print out the form, affix your photograph and signature, attach the required documents, and mail them to one of the nearest UTIITSL offices listed below:

PAN PDC Incharge – Mumbai region

UTI Infrastructure Technology And Services Limited

Plot No. 3, Sector 11, CBD Belapur,

Navi Mumbai – 400614

PAN PDC Incharge – Kolkata region

UTI Infrastructure Technology And Services Limited

29, N. S. Road, Ground Floor,

Opp. Gilander House and Standard Chartered Bank,

Kolkata – 700001

PAN PDC Incharge – Chennai region

UTI Infrastructure Technology And Services Limited

D-1, First Floor,

Thiru -Vi-Ka Industrial Estate,

Guindy, Chennai – 600032

PAN PDC Incharge – New Delhi region

UTI Infrastructure Technology And Services Limited

1/28 Sunlight Building, Asaf Ali Road,

New Delhi -110002

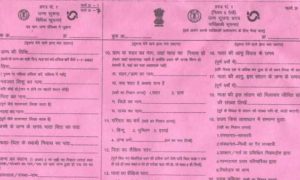

Update PAN offline: Steps to follow

Access the PAN card correction form from the internet and download it.

Complete all sections of the form accurately and gather necessary documents.

Submit the filled form along with the required documents at the nearest PAN centre.

Upon submission and payment, obtain an acknowledgment slip from the centre.

Within a 15-day period, send this acknowledgment slip to the Income Tax PAN Service Unit of the NSDL.

Documents for updating PAN card details

Duplicate of PAN card

Proof of identity, such as Aadhaar card, Voter’s ID, driver’s licence, ration card, etc.

Proof of address, such as Aadhaar card, Voter’s ID, property tax receipts, utility bills, etc.

Evidence of date of birth, Aadhaar card, Voter’s ID, birth certificate, matriculation mark sheet, etc.