Among all public sector banks, Indian Overseas Bank is currently offering the highest interest rate of 7.3% on a tenure of 444 days. For shorter investment horizons, the bank is offering a competitive 6.9% interest rate on 1-year fixed deposits. Customers looking for longer-term FDs will be offered rates of 6.5% on 3-year and 5-year…

Fixed deposit interest rates: If we compare fixed deposit rates of public sector banks with small finance banks or non-bank lenders, the former’s rates are lower but people still prefer to park their money in public sector banks. It’s because the public sector banks have government backing and a robust presence across the country, which gives customers a sense of confidence and reliability.

Read More: Bajaj Finance Flexible FD Options Cater To Diverse Financial Needs

On the other hand, small finance banks function with smaller capital bases and face tough competition from bigger rivals when it comes to getting business. To remain competitive, they often have to resort to unsecured lending to riskier segments of the population, which makes them prone to defaults and non-performing assets. Besides, people also focus on whether or not their fixed deposit is secured under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme, which covers deposits up to Rs 5 lakh for both principal and interest amounts. So, in case the bank goes insolvent, fixed deposits remain safe.

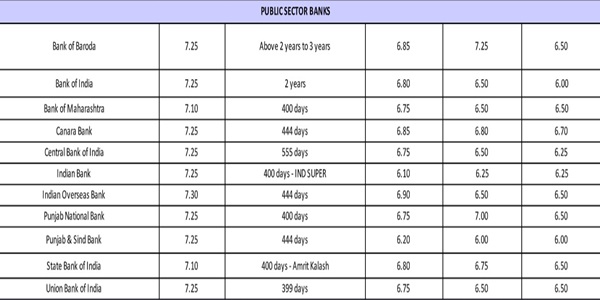

Here is a list of 11 public sector banks offering high interest rates. The data is compiled by paisabazaar.com.

Indian Overseas Bank

Among all public sector banks, Indian Overseas Bank is currently offering the highest interest rate of 7.3% on a tenure of 444 days. For shorter investment horizons, the bank is offering a competitive 6.9% interest rate on 1-year fixed deposits. Customers looking for longer-term FDs will be offered rates of 6.5% on 3-year and 5-year deposits.

Read More: Rupee Rises 6 Paise Against US Dollar As Crude Oil Prices Ease

Bank of Baroda

Bank of Baroda offers a range of competitive fixed deposit interest rates across various investment horizons. It offers the highest interest rate of 7.25% on tenures ranging 2 to 3 years. The bank offers a 6.85% interest rate on 1-year fixed deposits, 7.25% interest rate for a 3-year term and 6.5% on 5-year FDs.

Bank of India

Bank of India too offers a range of competitive FDs in terms of interest rates. With its highest interest rate of 7.25% for a tenure of 2 years, the bank is offering a good option for investors looking for medium-term opportunities. For shorter durations, an attractive 6.80% interest rate on 1-year fixed deposits is offered. Customers seeking longer commitments can go for 3-year fixed deposits, which will fetch them 6.5% interest rate. The bank is offering a 6% rate on 5-year fixed deposits.

Canara Bank

Canara Bank offers its highest interest rate of 7.25% for tenures of 444 days. For shorter durations, its rates of interest are 6.85% for 1-year fixed deposits, 6.8% for 3-year FDs and 6.7% for 5-year fixed deposits.

Central Bank of India

Central Bank of India offers a range of competitive fixed deposit interest rates, with its highest interest rate at 7.25% for tenures of 555 days. The bank offers a favorable 6.75% interest rate on 1-year fixed deposits. The bank’s rates of 6.5% on 3-year fixed deposits and 6.25% on 5-year fixed deposits are also competitive.

Indian Bank

Indian Bank offers a variety of fixed deposit interest rates for different investment preferences. Its “IND SUPER” scheme provides an attractive highest interest rate of 7.25% for tenures of 400 days. It offers a competitive 6.1% interest rate on 1-year fixed deposits and 6.25% for both 3-year and 5-year FDs.

Punjab National Bank

Punjab National Bank offers its highest interest rate of 7.25% for tenures of 400 days. It offers a favorable 6.75% interest rate on 1-year fixed deposits. The bank’s interest rates stood at 7% for 3-year fixed deposits and 6.5% for 5-year FDs.

Punjab & Sind Bank

Punjab & Sind Bank offers its highest interest rate of 7.25% for tenures of 444 days. The bank offers a competitive 6.2% interest rate on 1-year fixed deposits. Its rates of 6% on both 3-year and 5-year fixed deposits are also good options.

Union Bank of India

Union Bank of India offers its highest interest rate of 7.25% for tenures of 399 days. For shorter durations, its rates are 6.75% for 1-year fixed deposits, 6.5% for both 3-year and 5-year FDs.

State Bank of India

State Bank of India is providing its highest interest rate of 7.1% for tenures of 400 days under the “Amrit Kalash” scheme. The scheme is an attractive option for investors seeking medium-term growth. It provides a competitive 6.8% interest rate on 1-year fixed deposits, 6.75% on 3-year FDs and 6.5% on 5-year deposits.

Bank of Maharashtra

Bank of Maharashtra offers its highest interest rate of 7.1% for tenures of 400 days. The bank offers a 6.75% interest rate on 1-year fixed deposits. Its rates of 6.5% on both 3-year and 5-year fixed deposits are also good.