Are you planning to buy a new car? So before you jump into the driver’s seat, you need to enquire about your loan options. Comparing the interest rates, processing fees, and other charges of at least 2 to 3 banks will help you make a smart decision.

Cheapest car loans in May 2024: Amidst rise in car prices, banks time to time review their loan eligibility criteria for car buyers. Most banks have now eased the difficulty level in terms of documentation for loan sanctioning by moving the whole process online. Besides, the lenders have reviewed their processing fee and the maximum loan amount eligibility for customers. Some top lenders are now offering zero-down payment car loans, disbursing loans upto 100% of the on-road price of vehicles.

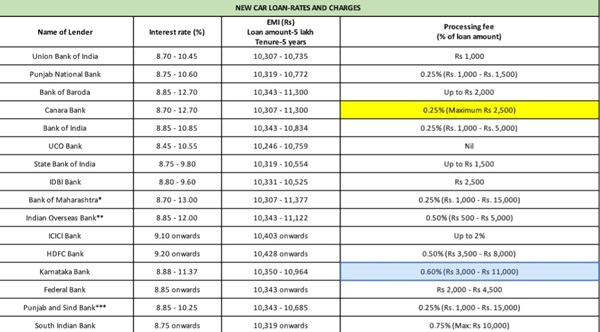

Are you planning to buy a new car? So before you jump into the driver’s seat, you need to enquire about your loan options. Comparing the interest rates, processing fees, and other charges of at least 2 to 3 banks will help you make a smart decision. As a car buyer, you should know the latest updates on car loan rates and charges offered by various banks. There would be banks who might offer you a car loan with zero processing fee and the lowest interest rate. Here is a list compiled by paisabazaar.com on public sector banks offering the cheapest car loans.

UCO Bank

Interest Rate: 8.45% to 10.55%.

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,246 to Rs 10,759.

Processing fee (% of loan amount): NIL.

Read More: Fixed Deposits: Which public sector banks are offering best FD interest rates?

Union Bank of India

Interest Rate: 8.70% to 10.45%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,307-Rs 10,735

Processing fee (% of loan amount): Rs 1,000.

Canara Bank

Interest Rate: 8.70% to 12.70%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,307-Rs 11,300

Processing fee (% of loan amount): 0.25% (maximum Rs 2,500)

Bank of Maharashtra

Interest Rate: 8.70% to 13%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,307-Rs 11,377

Processing fee (% of loan amount): 0.25% (Rs 1,000-Rs 15,000)

State Bank of India

Interest Rate: 8.75% to 9.80%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,319-Rs 10,554

Processing fee (% of loan amount): Up to Rs 1,500

Read More: Top 7 SIP Mutual Fund in 10 Years: Rs 10K SIP in the top fund has given over Rs 54 lakh

Punjab National Bank

Interest Rate: 8.75% to 10.60%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,319-Rs 10,772

Processing fee (% of loan amount): 0.25% (Rs 1,000-Rs 1,500)

IDBI Bank

Interest Rate: 8.80% to 9.60%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,331-Rs 10,525

Processing fee (% of loan amount): Rs 2,500.

Bank of India

Interest Rate: 8.85% to 10.85%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,343-Rs 10,834

Processing fee (% of loan amount): 0.25% (Rs 1,000 to Rs 5,000).

Indian Overseas Bank

Interest Rate: 8.85% to 12%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,343-Rs 11,122

Processing fee (% of loan amount): 0.5% (Rs 500 to Rs 5,000).

Bank of Baroda

Interest Rate: 8.85% to 12.70%

EMI (loan amount Rs 5 lakh for 5 years): Rs 10,343-Rs 11,300

Processing fee (% of loan amount): Up to Rs 2,000.