Senior Citizens FDs are fixed deposit schemes offered by banks and financial institutions exclusively for individuals above a certain age threshold, usually 60 years or older.

Fixed deposits (FDs) have long been a popular investment choice among Indians, especially senior citizens looking for stability and regular income. Senior Citizen FDs are specifically tailored to cater to the needs of this demographic, offering higher interest rates and other benefits.

However, before diving into these investments, it’s crucial to understand the nuances and considerations to make the most of them.

Read More: How a home loan can help you optimise your tax saving

Understanding Senior Citizens FDs

Senior Citizens FDs are fixed deposit schemes offered by banks and financial institutions exclusively for individuals above a certain age threshold, usually 60 years or older. These FDs typically offer higher interest rates than regular FDs, making them an attractive option for retirees or those looking for stable income streams during their golden years.

Key Benefits

* Higher Interest Rates

Senior Citizen FDs usually offer interest rates that are 0.25% to 0.75% higher than regular FDs. This additional interest can significantly boost your income, especially over the long term.

* Stable Returns

FDs are known for their stability and predictability in returns, making them a preferred choice for risk-averse investors, particularly seniors.

* Regular Income

Many senior citizens rely on FD interest as a steady source of income, especially after retirement. FD interest payouts can be monthly, quarterly, semi-annually, or annually, providing flexibility based on your cash flow needs.

Read More: SBI Hikes Fixed Deposit Interest Rates: Check How Much You Can Earn From 46 Days To 1 Year

* Tax Benefits

Under Section 80TTB of the Income Tax Act, senior citizens are eligible for a deduction on the interest earned from deposits with banks, co-operative banks, and post offices. This helps in reducing the tax burden for retirees.

Senior Citizens FDs offer an attractive avenue for retirees and older investors seeking stable income and moderate growth. By considering key factors such as interest rates, tax implications, investment tenure, and diversification strategies, senior citizens can optimize their FD investments to meet their financial goals while mitigating risks. Balancing FDs with other investment instruments can further enhance overall portfolio returns.

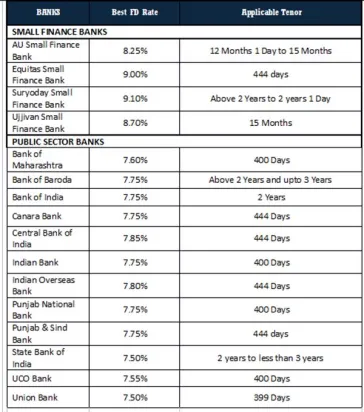

The table below compares the interest rates along with applicable tenure of senior citizens FDs. You can compare and choose the one that suits your financial goals and needs.

Data as on respective banks’ website on 10 May 2024.

Note: Highest interest rates on term deposits for senior citizens (Deposit amount below Rs 2 Cr) offered by small finance banks and public banks are considered for data compilation. Banks whose websites don’t mention the data are not considered.

Compiled by BankBazaar.com