On a fuel credit card, a customer not only gets surcharge waiver but also free fuel on their spendings at petrol pump. One such product is offered by HDFC Bank. IndianOil HDFC Credit Card offers you a chance to earn up to 50 litres of fuel annually on your everyday spends.

Best fuel credit card: Selecting a credit card can be confusing as there are a plethora of options available for customers. Banks customize offers and benefits on their cards based on user preferences. Card issuers are offering on their products unique benefits like cashback, discounts, reward points and fuel points – specifically for fuel purchases, etc.

Through a fuel credit card, a customer not only gets surcharge waiver but also free fuel on their spendings at petrol pump. One such product is offered by HDFC Bank. IndianOil HDFC Credit Card offers you a chance to earn up to 50 litres of fuel annually on your everyday spends. Following are the key features and benefits of this fuel card, according to the HDFC Bank website.

Read More: Govt Cuts Windfall Tax on Crude Petroleum

IndianOil HDFC Credit Card Key Features:

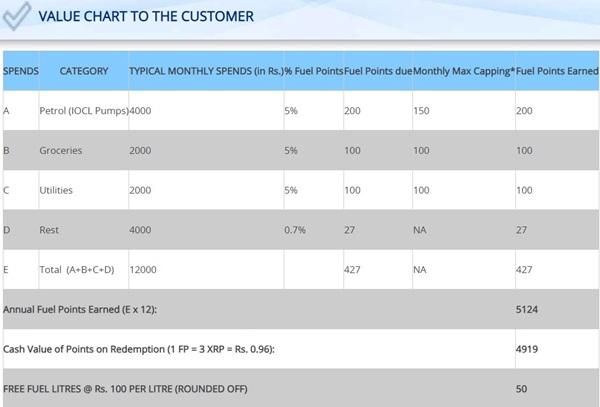

- You can earn up to 50 litres of free fuel annually;

- Earn 5% of your spends as fuel points at IndianOil outlets (Max 250 fuel points per month in first 6 months, Max 150 Fuel Points post 6 months from card issuance);

- Earn 5% of your spends as fuel points on groceries and bill payments (Max 100 fuel points per month on each category);

- Earn 1 fuel point for every Rs 150 spent on all other purchases (including UPI transactions).

Additional Features on IndianOil HDFC Credit Card:

- The card offers complimentary IndianOil XTRAREWARDSTM Program (IXRP) membership;

- Revolving credit: IndianOil HDFC Bank Credit Card offers revolving credit facility at nominal interest rate;

- Zero lost card liability: In the unfortunate event of you losing your IndianOil HDFC Bank Credit Card, you should report it immediately to the bank’s 24-hour call centre. After reporting the loss, you have zero liability on any fraudulent transactions made on your credit card. Read More: Godrej Family Split 127 Year Old Business; Adi, Brother To Keep Listed Firms; Jamshyd To Get Unlisted Cos, Land Bank

Source: HDFC Bank website

Fuel Surcharge Waiver:

This card offers 1% fuel surcharge waiver at all fuel stations across India (on minimum trasaction of Rs 400. Max CashBack of Rs 250 per statement cycle).

Read More: Rs 2 dividend, June 14 record date: Good news from Adani Group company

Fuel Points Accrual:

- Fuel point is an exclusive rewards metric system created only for IndianOil HDFC Bank Credit Card holders, the bank says.

- Earn Fuel Points on retail spends with the IndianOil HDFC Bank Credit Card

- Earn accelerated 5% Fuel Points on spends at IndianOil outlets, groceries and bill payments.

(Accelerated 5% fuel points benefit will be given only for fuel transactions on IndianOil Retail Outlets.)

Fuel Point Redemption:

A customer can redeem fuel points for free fuel using the complimentary IndianOil XTRAREWARDSTM Program (IXRP) membership. Redemption at participating IndianOil petrol outlet by converting fuel points into XRP (where 1 FP = 96 paise).

Fuel Points Validity: Fuel points are valid for a period of 2 years.