The Pension Fund Regulatory and Development Authority (PFRDA) has shared the latest charge structure for point of presence (PoP) under the National Pension Scheme (NPS). Point of Presence (PoPs) are entities appointed by the PFRDA to provide services to all the citizens of India to open and operate their NPS accounts.

Read More: Mutual fund KYC: A look at these new KYC rules for mutual fund investors

They perform functions through their network of branches called POP Service Providers (POP-SP). The operations of these POP-SPs are coordinated and controlled by the POP. A PoP-SP is the first point of contact between you and the NPS.

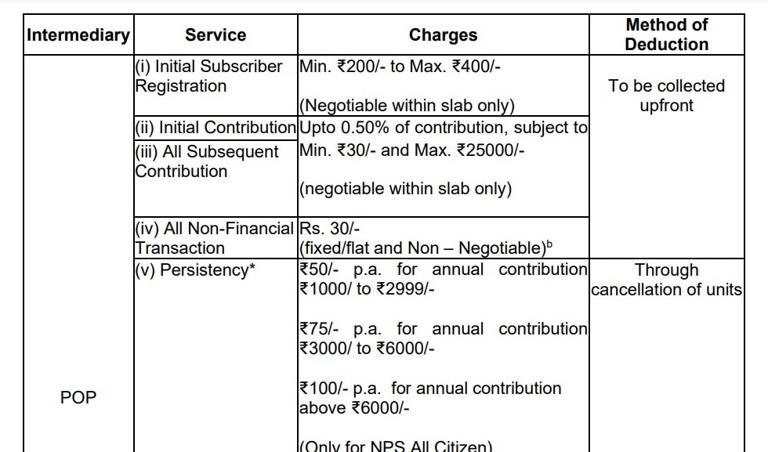

“The PoPs will continue to have the option to negotiate the charges with the subscribers, but within the prescribed minimum and maximum charge structure,” said PFRDA in a master circular dated April 25, 2024.

The circular further said: “Persistency charge per financial year will be applicable on accounts under NPS- All Citizen Model where the subscribers are associated with the PoPs for more than six months in a financial year. This charge will be payable annually to the associated PoPs by deduction of the units in the CRA system after closure of the financial year.”

Read More: Home Loans: Top 5 banks including HDFC, SBI with lowest rates of interest – check full list

Here are the revised charges: