Among the many benefits that the HDFC Bank HealthCover FD offers, the scheme gives instant access to an overdraft of up to 90% of the fixed deposit amount.

Leading private sector lender HDFC Bank offers a unique investment product with a dual benefit of a fixed deposit and the safety of hospital cash cover.

On booking a HealthCover FD, customers will receive cash cover during hospitalisation in the first year.

Read More: Small Savings Schemes: Investing in PPF, SSY, SSCS? Can you invest without Aadhaar Card? EXPLAINED

Here are the benefits and features of the HDFC Bank HealthCover FD:

- The Healthcover FD gives instant access to an overdraft of up to 90% of the fixed deposit amount.

- The FD scheme increases income with compound interest on reinvestment deposits

- An FD holder can choose from options of monthly or quarterly interest payouts.

- HealthCover FD gives Rs 500 per day for 15 days to cover hospital cash expenses on a fixed deposit with a balance of Rs 5 lakh to Rs 10 lakh.

- On FD amounts less than or equal to Rs 10 lakh to Rs 1.99 crore, the scheme fetches a benefit of a hospital cash cover of Rs 1000 per day for 15 days.

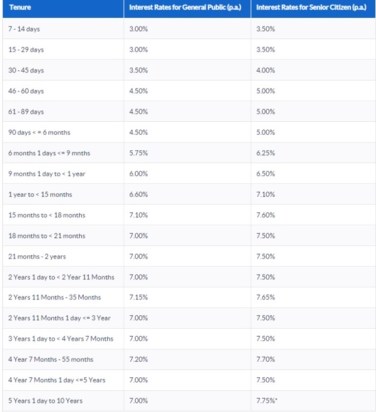

HDFC Bank HealthCover FD Interest rates:

The bank is offering interest rates up to 7.75% on HealthCover FD. The rates are applicable on below Rs 2 crore fixed deposits. Here is a table showing rates across tenures for both general public and senior citizens.

Source: Bankbazaar.com

HDFC Bank HealthCover FD eligibility criteria:

If you’re aged between 18 and 59 years, you can apply for an HDFC Bank HealthCover fixed deposit. The FD terms range from 1 to 10 years. Your fixed deposit must fall within the range of Rs 5 lakh to Rs 1.99 crore to meet the eligibility criteria.

Read More: Bank FD Rates: From SBI, PNB To HDFC & ICICI Bank; Check Latest Fixed Deposit Rates

How to book the HDFC Bank HealthCover FD online?

Step 1: Go to HDFC Bank https://www.hdfcbank.com/

Step 2: Log in via NET Banking; once logged in, click on ‘Accounts’.

Step 3: Select the ‘Transact’ option.

Step 4: Now, various options will appear; Choose the ‘Fixed Deposit’ option.

Step 5: Select the below Rs 2 crore option.

Step 6: From drop-down menu, select ‘HealthCover FD’.

Step 7: Enter the amount you want to deposit and select tenure.

Step 8: Fill in all the details correctly.

Step 9: You also have the option to check the maturity amount and current interest rates applicable to your deposit.

Step 10: A confirmation will be sent via SMS and email once the FD is booked.