India’s mutual funds have bought fresh stake in state-run Rural Electrification Corporation Ltd. (REC) in the month of March, according to a note from Nuvama Alternative & Quantitative Research.

Read More: Stock Market Updates: Sensex Down 600 Points, Nifty Below 22,350; Tata Steel Dips 2%

Around 35 fund houses held an 8.32% stake in REC as of the December quarter shareholding pattern on BSE. The stock was the best performer on the Nifty PSE index in 2023, gaining as much as 2023.

According to Nuvama, Mutual Funds increased their stake in largecap names like Reliance Industries and TCS. The shift to private largecap banks was also evident as they also increased stake in lenders like HDFC Bank and Kotak Mahindra Bank in the month gone by.

But while funds have increased stake in one IT major, they have reduced stake in another one and that is Infosys. Among other major largecap names where funds have pared down stake, include India’s largest lender – State Bank of India.

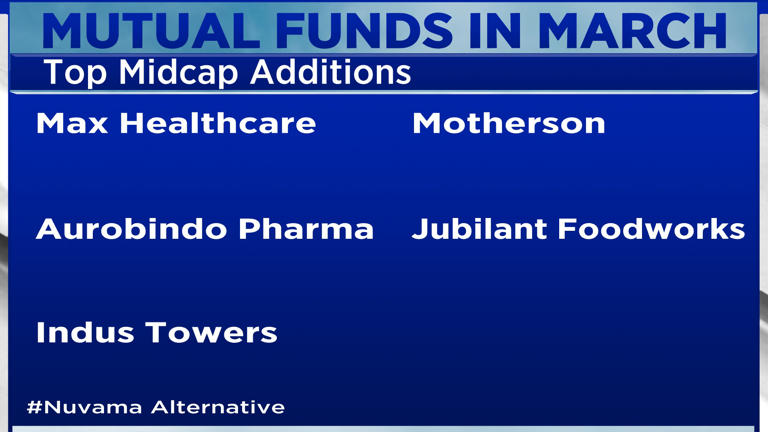

Among the top midcap additions in the month of March, includes stocks like Indus Towers, which has seen a stellar run so far in 2024. The stock went up 15% in March on hopes of recovery of further dues from Vodafone Idea on completion of the latter’s fund raise.

Read More: Ramdevbaba Solvent IPO opens today: Check price band, dates and key details before subscribing

The stock is also up 13% so far in April. Another notable addition among the midcaps is Jubilant Foodworks, a beaten down name, with the stock having declined over 20% so far this year.

Among the top Smallcap additions include the likes of Aster DM Healthcare, which recently announced a special dividend of ₹118 per share, post the sale of its GCC business and an underperforming name like Aditya Birla Sun life AMC, which is still trading below its IPO price.

Some other interesting observations from the mutual fund activity in the month of March:

Tata Chemicals: The Tata Group stock saw a sharp surge recently in view of Tata Sons’ potential listing and then saw a sharp correction from the highs when news of the listing not taking place surfaced. Here, Quant MF and ICICI Prudential MF bought fresh stake in March.

IREDA: The state-run renewable energy player saw three mutual funds – Nippon India MF, Kotak MF, ICICI Prudential MF exit their positions in March. Notably, none of the three funds had a stake in excess of a percent based on the December shareholding.

Tata Technologies: Another Tata Group stock which saw a stellar listing last year has seen funds like Nippon India and ICICI Prudential exit their positions in March. The stock, though well above its IPO price, continues to trade below its listing price of ₹1,200.

Lancer Container Lines: A stock not spoken about often but has a ₹1,600 crore market capitalisation has seen Quant MF acquire 2.5% stake in March, as evident from the company‘s March shareholding pattern. The stock is down 14% this year but has risen 35% over the last 12 months.

Read More: Grill Splendour Services IPO opens: All you need to know before subscribing

Hindustan Unilever: In some FMCG reshuffle, Axis MF has exited the underperforming stock and has instead increased its stake in peer company Colgate-Palmolive in March.