For the longest time, even to date, non-banking financial companies (NBFCs) and fintech companies have run successful co-lending arrangements wherein the former provides the capital, and the latter takes care of the entire loan process, including sourcing, with a digital interface.

However, a fascinating convergence trend is unfolding.

Read More: Infosys Share Price Target Before Q4 Results; Know More On Date & Dividend

As fintech startups eye NBFC licences to gain trust, scale, and regulatory advantages, NBFCs are increasingly upping their in-house technology prowess to directly source customers.

The latest to join the bandwagon is Aditya Birla Capital Ltd., one of the country’s most popular non-banks or ‘shadow lenders’, which is set to launch its mega direct-to-customer fintech app—ABCD–offering various financial products on a single digital platform.

Currently on trial in a closed user group, the app, housed under the newly carved out subsidiary Aditya Birla Capital Digital (ABCD), is expected to be thrown open to customers on April 16.

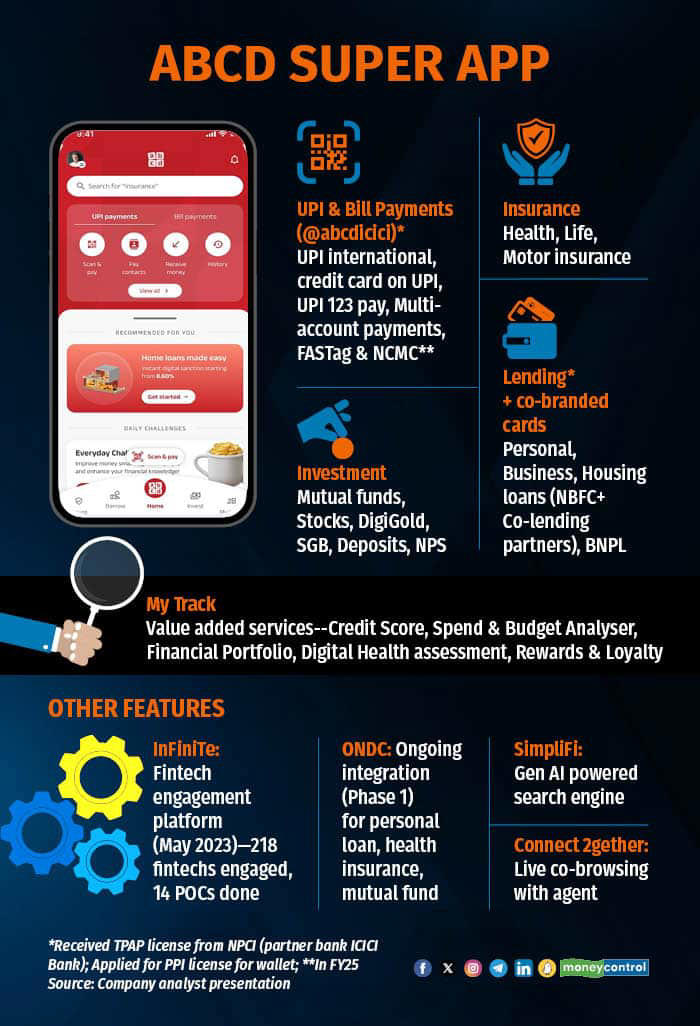

From payments to insurance, the fintech app will amalgamate all the group’s financial offerings, along with everything else a fintech app could offer such as credit cards, payments stack, including international UPI, financial goal analysers, generative AI-powered chatbots, tax planners, and health tracking.

“It’s a full-fledged app (rather than an app-in-app). It has many industry firsts and has been meticulously built and enriched with customer insights to offer products across lending, investments, insurance, and payments. Plus, value-added services such as Credit Score, Financial Portfolio, Spend Analyzer and more. This can empower the workforce of ABCL as multi-product specialists,” analysts at Motilal Oswal noted.

Flow chart of financial subsidiaries housed under Aditya Birla Group

ABCD follows what conglomerate-backed Jio Financial Services and Tata Digital have attempted—a single super financial app with captive businesses, capital and tech muscle.

“It would all depend on the execution,” said a senior financial consultant, reminiscing Aditya Birla’s attempt in the past to launch standalone financial apps.

“They were ahead of their time with a similar personal finance app called Myuniverse, which did not work unfortunately… They are harnessing the data capability big time with this and have all the right ingredients and muscle. However, competition from Jio, Piramal, Tata and other NBFCs will have to be watched as you will see more non-banks following suit,” he said.

ABCD universe

ABCD, bundled with the services of its financial subsidiaries, including NBFC arm Aditya Birla Finance, is targeting middle-class and tech-savvy ‘young aspirers.’

With 762 branches and over 200,000 agents/channel partners nationwide, holding firm ABCL boasts of Rs 4.1 lakh crore of assets under management with a consolidated lending book of about Rs 1.15 lakh crore through its subsidiaries and joint ventures.

Additionally, the group infused equity capital amounting to Rs 850 crore in Aditya Birla Finance to support the growth momentum.

Last year, it launched a merchants’ payments/collection app– Payments lounge– with Phicommercem, clocking a monthly run rate of Rs 500+ crore in gross merchandise value (GMV) in the first six months.

Main features of ABCD app

On the consumer front, ABCD will be embedded with a payments stack, including UPI (Unified Payments Interface) and bill payments. It aims to catch up with major new offerings in the ecosystem, including UPI international, Rupay credit cards on UPI, and UPI 123 pay—all three to go live in the upcoming app.

It received a third-party application provider (TPAP) licence from the National Payments Corporation of India in partnership with ICICI Bank and has applied for a Prepaid Payment Instruments (PPI) licence. The app will also offer merchant acquisitions and wallet services in FY25.

As a differentiator, ABCD will allow users to make a single payment by debiting multiple bank accounts.

“The unique functionality is to help consumers falling short of funds in one account,” it said.

New additions such as National Common Mobility Card (NCMC), which allows users to access a range of public transport services across the country, and forex services are to be made in FY25.

“Currently, the company is employing 106 analytical models spanning the customer lifecycle and various functional areas, with intentions to operationalise 400 predictive and prescriptive models by FY25,” it added.

Read More: Petrol, Diesel Fresh Prices Announced: Check Rates In Your City On April 15

Per the plans, Aditya Birla is keen to engage with fintech companies via its startup engagement platform—Infinite– to solve business problems and drive faster adoption of emerging technologies. About 14 proof of concept tests were conducted as of January since the programme’s launch in May last year.

Though in the early stage, Aditya Birla Finance and Aditya Birla Health Insurance are in the first phase of integrating personal loans, health insurance and mutual funds on the Open Network for Digital Commerce (ONDC) platform.

Co-lending vs direct channel

Regulatory measures from the Reserve Bank of India such as guidelines on digital lending and unsecured loans have prompted NBFCs to adopt a more cautious stance over the past year as they bolster in-house capabilities while maintaining collaborative partnerships with fintech startups.

Recently, RBI deputy governor M Rajeshwar Rao emphasised the need to uphold stringent underwriting standards and prudent risk pricing, warning against compromises in these areas as NBFCs engage with fintech partners for customer acquisition.

The sentiment is resonating across the sector, prompting NBFCs such as ABCL and Piramal to reassess their reliance on such arrangements and prioritise strengthening direct sourcing channels for lending, said the founder of a digital lending startup.

“NBFCs have been watching everything from behind the scenes. There is a pressure from the regulator for a balanced approach. Having said that, co-lending will continue to grow stronger as the opportunity in lending, both consumer and MSME, is way too large for every model to co-exist,” the founder said.

Aditya Birla Finance, the NBFC entity of the group, has forged major partnerships with fintechs for co-lending personal, BNPL and merchant loans

In February, the ABCL management reiterated that its sourcing through direct channels, both offline and online, for MSME and business loans has gone up while efforts are ongoing to replicate it in the personal loan segment. For ABCL, 14 percent of its these partnerships are around consumer loans, typically personal and buy-now-pay-later loans.

“…most of the digital partnerships and the acquisition is in our consumer side, which is a portfolio that we are actively trying to reduce, and which has come down from Rs 4,200 crore to around Rs 2,600 crore now. And we will continue to reduce this,” said Vishakha Mulye, chief executive officer at ABCL.

Similar views were resonated by Piramal Enterprise.

“So right now, business done through partnerships is better economics,” said Jairam Sridharan, MD at Piramal Capital & Housing Finance. “However, in the long run, you do want to have your own channels originating a lot of these businesses, so you will continue to see us invest in own channels and continue to bring that up.”

Besides traditional NBFCs, ABCD’s ambition is also close to what Sachin Bansal’s fintech firm Navi, an NBFC, is following. Navi, which has a mobile first approach, is taking a direct customer acquisition strategy through its channel to gain better margins.

Typically, a 2-3 percent of the margin on loans goes to fintech partners.

Read More: Gold Rate Falls In India: Check 22 Carat Price In Your City On April 15

Digital lending expert Parijat Garg expressed optimism regarding the D2C model for NBFCs, emphasising the importance of effective execution. While acknowledging that it may take time for microfinance and MSME-focused NBFCs to transition to direct digital platforms, Garg noted that ABCL, with its urban demographic spread, is well-positioned for adoption of the new app.

“They are following the Bajaj (Finance) model. It’s another large NBFC practically doing everything. They work with partners as well, but are frontrunners in standalone digital lending, not depending much on fintech partnerships. ABCL has a lot of touchpoints and captive businesses and much better equipped today with technology, analytics and now the D2C app,” he said.