Banks typically offer dedicated helpline numbers and online portals for customers to lodge complaints if their concerns aren’t addressed by the branch manager.

Banking customers often face numerous challenges and seek prompt resolution of their complaints. Common grievances frequently cited by customers include excessive fees imposed by banks for services such as ATM withdrawals, bounced checks, and failure to maintain minimum balances.

Read More: New Insurance Policies To Go Digital From April 1: Here’s All You Need To Know

Nonetheless, certain grievances are intrinsic to individual banks and necessitate resolution from within. This may encompass issues such as inadequate customer service. Clients frequently lament the subpar customer service rendered by banks, citing prolonged wait times, unresponsiveness from customer care, and ambiguity surrounding procedures as prevalent concerns.

Numerous instances of fraudulent activities, including unauthorised transactions, phishing, and identity theft, have been reported by customers. Additionally, grievances extend to technical hitches encountered in online banking services, such as delayed or unsuccessful transactions, inaccurate balance displays, and system malfunctions.

Customers have lodged complaints about unjust lending practices employed by banks, including the imposition of exorbitant interest rates, the imposition of undisclosed fees, and the provision of unsolicited loans.

Numerous customers have voiced grievances regarding banks’ misrepresentation of financial products, including insurance policies, mutual funds, and credit cards, wherein complete information regarding terms and conditions was not provided.

In light of these circumstances, customers are growing increasingly frustrated by the prolonged delays in addressing their complaints and grievances, with some cases remaining unresolved for months or even years.

It’s crucial to acknowledge that not all banks encounter these issues, and many have internal mechanisms for addressing complaints, spanning from branch-level to headquarters. Banks typically offer dedicated helpline numbers and online portals for customers to lodge complaints if their concerns aren’t addressed by the branch manager.

In India, filing a complaint with the Reserve Bank of India’s Ombudsman and monitoring its status has become straightforward and effortless.

Customers should be aware that before seeking assistance from the Ombudsman, it is obligatory to initially file the complaint with the respective bank. Only if there is no response received from the bank within 30 days of lodging the complaint, or if the complaint is either wholly or partially rejected by the bank, can it then be escalated to the Ombudsman for further action.

Read More: How To Retrieve Lost or Forgotten Aadhaar Number? Check Step-by-step Guide Now

How To Complain Against The Bank To The RBI?

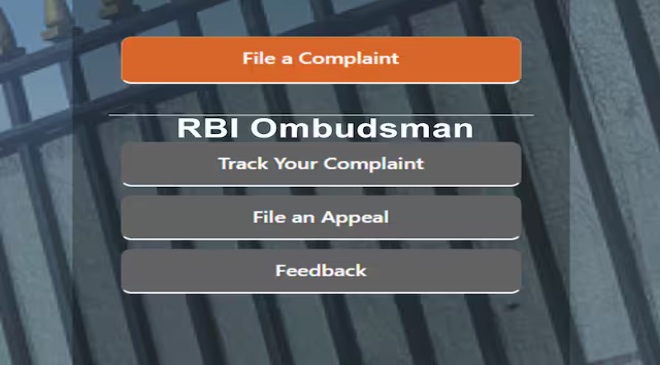

If your complaint against any bank, NBFC, or payment system participant is dismissed or not resolved to your satisfaction by the relevant entity, you now have the option to file a complaint through the Complaint Management System (CMS) portal on the RBI website (https://cms.rbi.org.in) or via the link provided on the RBI App.

The CMS offers a unified platform for swift and convenient online complaint filing, tracking, and the initiation of appeals. All complaints registered on the CMS platform will be directed to the relevant office of the RBI Ombudsman or regional offices of the RBI.

This website is highly user-friendly, offering guidance on how to file a complaint, the necessary details/documents for filing, tracking procedures, and instructions for filing appeals against the Ombudsman. Additionally, it provides contact information for Consumers’ Education and Protection Cells, including addresses and mailing lists.