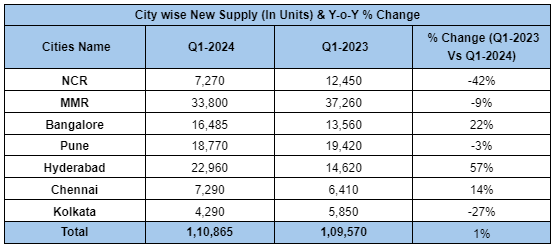

The top 7 cities recorded new launches of around 1,10,865 units in Q1 2024 against 1,09,570 units in Q1 2023,

Read More: Luxury homes priced above Rs 50 cr see remarkable increase in sales

The bull run in the Indian housing market continued in the first quarter of the year. Quarterly housing sales are at an all-time decadal high with approx. 1,30,170 units sold in Q1 2024 across the top 7 cities, revealed the latest Anarock data. This is a 14% yearly rise against approx. 1,13,775 units sold back in Q1 2023.

Despite new launches remaining above the 1 lakh mark in this quarter, available inventory in the top 7 cities dropped by 7% annually – from approx. 6,26,750 units by Q1 2023-end to approx. 5,80,890 units by Q1 2024-end.

Among the top cities, NCR saw the highest decline of 27% in its unsold stock in Q1 2024. NCR’s unsold stock is currently lower than in other prominent cities like MMR, Pune, and Hyderabad.

Anuj Puri, chairman, Anarock Group, said, “MMR and Pune accounted for over 51% of the total sales in the top 7 cities, with MMR recording a 24% yearly jump and Pune witnessing an over 15% yearly rise. New launches across the top 7 cities continued above the one lakh mark but witnessed a mere 1% yearly rise – from 1,09,570 units in Q1 2023 to over 1,10,865 units in Q1 2024.”

“Notably, MMR and Hyderabad saw the maximum new supply, accounting for 51% of the total new launches across the top 7 cities,” says Puri. “Hyderabad saw a 57% yearly increase in new supply in Q1 2024, while MMR saw its new supply decline by 9% in the period. The quarter has recorded the highest ever sales in the last decade amid a significant rise in demand for high-ticket priced homes priced Rs 1.5 Cr and above.”

India’s overall economic scenario remains positive, with the country’s GDP growth rate pegged as the highest globally, and inflation also seems to be under control. This outlook supports enduring homebuyer sentiment.

New Launch Overview

The top 7 cities recorded new launches of around 1,10,865 units in Q1 2024 against 1,09,570 units in Q1 2023, increasing by just 1% over the previous year’s corresponding period. The key cities contributing to new launches in Q1 2024 were MMR (Mumbai Metropolitan Region), Hyderabad, Pune, and Bengaluru, which together accounted for 83% of the quarter’s supply addition.

MMR saw approx. 33,800 units launched in Q1 2024 – a decline of approx. 9% over Q1 2023. More than 59% of the new supply was added in the sub-Rs 80 lakh budget segment.

Hyderabad added approx. 22,960 units in Q1 2024 – a yearly jump of 57% over the corresponding period last year. Over 33% of the new supply was added in the high-ticket >Rs 1.5 Cr) price segment.

Pune added approx. 18,770 new units in Q1 2024 compared to 19,420 units in Q1 2023 – a decrease of 3%.

Bengaluru added approx. 16,485 units in Q1 2024 – a yearly increase of 22%. Approx. 66% of the new supply was in the mid-range and premium segments (Rs 40 lakh – Rs 1.5 Cr.)

Read More: YEIDA Raises Land Allotment Rates Ahead Of Noida International Airport Opening – Check New Prices

NCR saw new supply dip by over 42% against Q1 2023, with approx. 7,270 units launched in Q1 2024 against 12,450 units in Q1 2023. Notably, 55% of the new supply was added in the ultra-luxury segment (homes priced >Rs 2.5 Cr.)

Chennai added approx. 7,290 units in Q1 2024, a yearly increase of 14% over Q1 2023. At least 87% of the new supply was in the mid and premium segments (priced within Rs 40 lakh to Rs 1.5 Cr)

Kolkata added approx. 4,290 units in Q1 2024, a decline of 27% over Q1 2023. Approx. 90% of the new supply was in the affordable and mid segments (priced up to Rs 80 lakh.)

Overall Sales Overview

Approx. 1,30,170 units were sold in Q1 2024 – an increase of 14% over Q1 2023. NCR, MMR, Bengaluru, Pune, and Hyderabad together accounted for 91% sales in the quarter.

MMR saw the highest housing sales of approx. 42,920 units in Q1 2024, increasing by 24% over Q1 2023. Approx. 34,690 units were sold in Q1 2023

Pune saw approx. 22,990 units sold in Q1 2024, increasing by 15% over Q1 2023 when approx. 19,920 units were sold

Hyderabad recorded the sale of approx. 19,660 units in Q1 2024, a 38% increase over Q1 2023 when approx. 14,280 units were sold

NCR saw a 9% decline in housing sales – from approx. 17,160 units in Q1 2023 to approx. 15,650 units in Q1 2024.

Kolkata also saw a decline of 9% in housing sales in the period – from approx. 6,185 units in Q1 2023 to approx. 5,650 units in Q1 2024.

Bengaluru saw housing sales increase by 14% in Q1 2024 against Q1 2023, with approx. 17,790 units sold in Q1 2024 and approx. 15,660 units sold back in same period last year

Chennai saw approx. 5,510 units sold in Q1 2024 – a decline of 6% over Q1 2023, at least partially attributable to factors like introduction of Tamil Nadu government’s three-tier guideline values for apartment complexes in late 2023, and high stamp duty and registration charges.Price Movement

Average residential property prices across the top 7 cities have seen significant jump in the last one year – ranging between 10-32% in Q1 2024 when compared to Q1 2023, mainly due to increase in the prices of construction raw materials and overall rise in demand. Hyderabad and Bengaluru recorded the highest annual price jump of over 32% and 25%, respectively.

Read More: Pune’s property registrations touch 17,570; stamp duty collection at ₹620 crore

Available Inventory

Despite massive new supply added to the top 7 cities in Q1 2024, overall available inventory declined by 7% in Q1 2024 when compared to Q1 2023. The total available inventory in the top 7 cities as of Q1 2024-end stands at approx. 5.81 lakh units. At 27%, NCR witnessed the highest reduction in available inventory in Q1 2024 when compared to Q1 2023.