Credit cards have become more than just a convenient mode of payment; they have evolved into a means of financial freedom and accessibility. However, for many individuals, like 25-year-old Rohan (name changed), the allure of credit cards has led them down a perilous path of debt and financial distress.

Read More: Banks To Send Suspicious Transaction Report Daily Amid Elections

When Rohan got himself a credit card, little did he know that it would land him in a never-ending cycle of EMI payments. What began with Rohan fulfilling his aspirations purchasing a TV, laptop, and smartphone quickly spiralled into a nightmare of mounting debts and constant struggle.

“I got a credit card mainly to purchase some electronic items, like a TV, a laptop, and a phone,” Rohan confessed. “Since many online shopping sites offered zero-interest EMIs and I could earn rewards and cashbacks on top of it, it seemed like a smart thing to do.”

“I have not been able to completely pay off my credit card outstanding balance and have been paying just the minimum amount for the past few months,” he said.

Like Rohan, millions of Indians have got carried by the allure of credit cards and are fighting a constant battle to avoid defaulting on their EMIs.

Credit card spending in India is at an alarming level. So, are the defaults.

This comes at a time when getting a credit card has become easier than ever before, with banks and financial institutions aggressively promoting their offerings to consumers across the country.

For many, the power to purchase ends in a nightmare, with some even opting to go for personal loans to pay off credit card dues.

THE CREDIT CARD BOOM IN INDIA

India has adopted credit cards at a staggering pace.

Just a decade ago, credit cards were a rarity, with stringent eligibility criteria and low levels of financial inclusion hindering their widespread adoption.

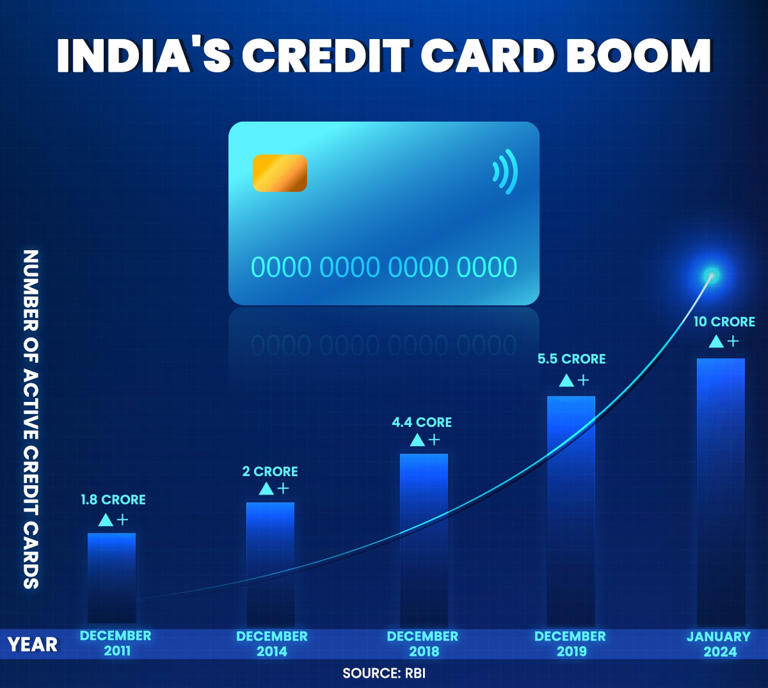

Data from the Reserve Bank of India (RBI) shows that there were less than 2 crore (1,76,72,337) active credit cards in India as of December 2011 and the figure increased to just over 2 crore (2,03,62,859) by the end of 2014. A slight rise in three years.

The number of active credit cards in India did not cross 3 crore in the next two years. By the end of 2018, the number of active cards was at 4.4 core.

Though credit card numbers in 2018 had more than doubled in comparison to 2011, it was nothing compared to the boom that was seen between 2019 and 2023.

During this period, there has been a significant rise in the number of active credit cards in the country from 5.5 crore (5,53,32,847) as of December 2019 to almost 10 crore (9,95,00,257) as of January 2024.

This represents an 81% increase in the number of active credit cards in the country.

In 2023 alone, over 1.6 crore credit cards were issued, compared to 1.2 crore credit cards added a year earlier.

A report prepared by PWC in 2022 highlighted that the credit card industry in India had witnessed a compound annual growth rate (CAGR) of 20%in the past five years.

It also highlighted that in May 2022 right about the time when the Indian economy was rebounding from the Covid-19 pandemic overall credit card spending reached its highest-ever number of Rs 1.3 lakh crore.

So, along with the number of credit cards issued, the spending through them was zooming too.

Credit card spending hit a fresh record high in October 2023 when it reached Rs 1.72 lakh crore.

And in the past three months, Indians have spent nearly Rs 5 lakh crore via credit cards nearly 2% of India’s total GDP.

This also indicates that the average ticket size of borrowing through credit cards has gone up significantly.

While the post-Covid spending frenzy has provided a significant push to credit card adoption and spending, there are bigger factors at play. The PWC report suggested that the emergence of e-commerce, adoption of contactless payments and changes in the value proposition, the post-pandemic credit card space has undergone a considerable change and is evolving constantly.

It noted that credit card adoption could grow at almost thrice the speed in the next four years.

CREDIT CARD DEFAULTS ON THE RISE IN INDIA

With greater credit card adoption and rising spends, defaults are rising too.

In 2022-23, credit card defaults stood at Rs 4,072 crore, which was over Rs 950 crore higher than the default of Rs 3,122 crore in 2021-22.

This alarming trend has attracted the Reserve Bank’s attention as well. Days after credit card spending hit a record high in October 2023, RBI Governor Shaktikanta Das said it was monitoring some components of personal or unsecured loans to identify stress.

“Certain components of personal loans are, however, recording very high growth. These are being closely monitored by the Reserve Bank for any signs of incipient stress,” Shaktikanta Das said.

His remark came amid a period where banks were broadening their unsecured lending portfolios, particularly in response to escalated credit card expenditures.

Despite the RBI’s warning and efforts to slow down unsecured lending, the bulk of credit card loans by banks have been to relatively riskier borrowers.

RBI economists in an analysis on retail credit flows highlighted that in November 2023, the outstanding credit card balance of banks rose 34% from a year earlier. It rose to Rs 2.4 lakh crore, accounting for 5% of total retail loans.

“In the case of credit cards, per live borrower credit outstanding is higher for the below-prime borrowers, suggesting a higher flow of credit to relatively riskier borrowers,” the RBI economists wrote in the research paper titled, ‘Dynamics of Credit Growth in the Retail Segment: Risk and Stability Concerns’.

Nilesh Tribhuvann, Founder & Managing Partner, White & Brief, Advocates & Solicitors, pointed out that the surge in credit card exposure underscores the evolving consumer behaviour after the Covid-19 pandemic.

“Despite the RBI’s risk weight adjustments on unsecured loans, credit card issuance is nearing the million milestone and is at 9.95 crore cards. HDFC Bank, with over two crore cards, maintains its lead among issuers. As legal advisors, we closely monitor this trend, recognising the delicate balance between increased spending and potential default risks,” he added.

THE ‘MINIMUM DUE’ CREDIT CARD DEBT TRAP

While there’s an increase in credit card defaulters, it’s only a fraction compared to the people who are stuck in a never-ending loop of monthly repayments, just like 25-year-old Rohan.

“I think credit cards and online shopping can be a dangerous combination if used irresponsibly, as they can lead to a debt trap,” Rohan told IndiaToday.In.

“Debt can quickly accumulate and become unmanageable. That’s why I’m always cautious about using my credit card,” he added.

Most people who purchase using credit cards usually get lured by lucrative offers like no-cost or low-cost EMI, which are applicable on almost all products online and even at physical stores.

These offers lead to a lot of impulse buying, and the outstanding balance keeps growing. What’s worse is that after a period of time, the interest rate on the due amount keeps compounding.

TAKING PERSONAL LOAN TO CLEAR CREDIT CARD DUES

And when people opt to pay the ‘minimum balance due’ instead of the total due for the month, they fall deeper into a debt trap, resulting in defaults, low-credit scores and even harassment.

This is what happened to Sohom (name changed) when he got his first credit card.

“This was after I passed out of college and went to Mumbai for work. Sustenance in the megacity was tough with my meagre income. I was offered a credit card along with the new salary account,” he told IndiaToday.in.

Soham used his credit card to fund his gym expenses and even bought a new iPhone. “I used my credit card with the limit of Rs 1.5 lakh. As expenses grew, so did my dues to the bank. Most months I would pay just the minimum due amount,” he added.

But as the payment burden grew, he started missing the payments.

“The bank started making calls, pressure was mounting. It was my mistake. It’s a temptation. Before things got out of hand, I took a personal loan from the same bank to clear the outstanding,” he recalled.

Soham faced a similar situation with another credit card he used to own. Luckily for him, he managed to borrow money from a friend and clear the dues.

There are countless examples of people who regret their decision to pay minimum dues on their credit card expenses.

Arijit (name changed) told IndiaToday.in that he also kept paying a bit more than the monthly minimum due for some time, following which the outstanding amount jumped to almost Rs 85,000.

“I kept paying just the minimum dues or just a bit more than that. I kept doing that for a while. It felt like the amount had compounded overnight,” he said.

As India grapples with its growing credit card culture, stories like Rohan’s, Sohom’s, and Arijit’s highlight the risks involved. While credit cards offer convenience, they can easily lead to a debt trap.