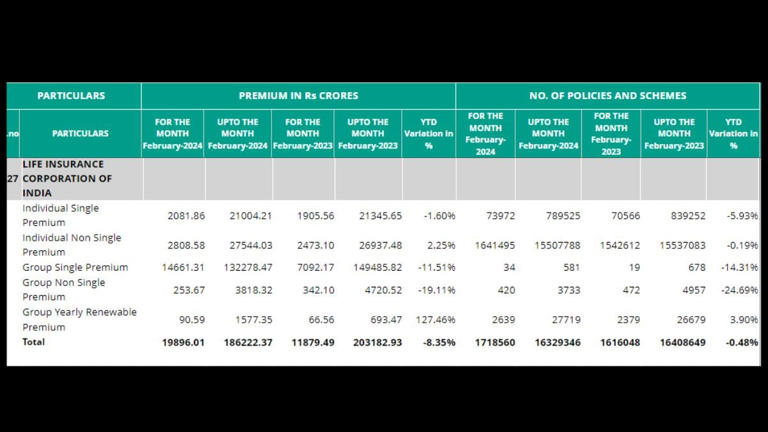

The Life Insurance Corporation of India (LIC) reported a doubling of its Group Premium, reaching Rs 14,914.98 crore in February 2024 compared to Rs 7,434.27 crore in the same month the previous year.

The Total Premium also saw a substantial increase of 67.48 per cent, amounting to Rs 19,896.01 crore, up from Rs 11,879.49 crore in February 2023.

Read More: 76 Students Hospitalized Due To Food Poisoning In Uttar Pradesh’s Greater Noida

Growth in policy numbers

In February 2024, there was a surge in the number of policies and schemes for LIC. The total number of policies across all categories increased by 6.34 per cent, reaching 17,18,560 compared to 16,16,048 in February 2023.

Key Highlights

In the segments of Individual Premium and Group Yearly Renewable Premium, LIC saw a growth rates of 11.69 per cent and 36.10 per cent, respectively, during February 2024. The number of policies in the group’s yearly renewable premium segment also increased by 10.93 per cent, totaling 2,639.

Read More: SBI’s request for more time on electoral bond disclosures based on ‘erroneous reading’ of SC order

February 2024 vs February 2023: Breakdown

1. Individual Category: Policies and Schemes

The individual category saw a 6.34 per cent rise in policies and schemes, reaching 17,15,467 in February 2024 compared to 16,13,178 in the same month of the previous year.

Read More: Kedarnath Temple opening date announced | Check details here

2. Group Yearly Renewable Premium: Policies and Schemes

The group’s yearly renewable premium segment recorded a 10.93 per cent increase in policies and schemes, totaling 2,639 in February 2024, up from 2,379 in February 2023.

3. Overall Policies: February 2024

Across all categories, the total number of policies increased by 6.34 per cent, reaching 17,18,560 in February 2024 compared to 16,16,048 in February 2023.

Life Insurance Corporation of India shares

The shares of LIC on Friday at 3:30 pm IST closed at Rs 1,025.50, up by 1,025.50 per cent.