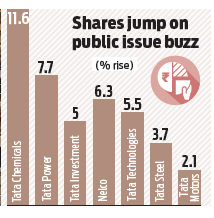

NEW DELHI: On speculations that Tata Sons mega listing will unlock value among group entities and simplify the complex group structure, Tata Group stocks are on a roll and surged as high as 16% intra-day on Thursday.

Read More: Federal Bank shares delivered similar returns in two and three years; what’s next?

“Tata group stock fundamental long-term stories are intact and they have outperformed in recent times. But the recent story of those stocks being in action like Tata Chem and others are based of Tata Sons, the holding company of all Tata companies, for which few reports say it is required by the RBI to list by September 2025. This has fuelled fresh fire in the group stocks due to cross holding structures,” said Prashanth Tapse, Sr VP Research analyst at Mehta equities.

Extending its winning streak for the sixth straight session, Tata Chemicals shares surged 14% intraday to hit a 52-week high of Rs 1,349 on the NSE before settling at Rs 1,311.60 apiece, up 11.30%. The scrip has surged more than 40% in the last 6 sessions as a report by equity research firm Spark Capital recently stated that Tata Chemicals’ 2.5% holding

in Tata Sons could potentially amount to Rs 19,850 crore or 80% of its market capitalisation. Besides Tata Chemicals, Tata Motors, Tata Power, Tata Steel, Rallis India, Tata Power, Nelco and Tata Investment Corporation marched ahead and witnessed strong buying on Thursday. Among the 17 active listed Tata stocks, only Titan (down 0.6%) closed with a cut on Thursday.

Shares of Rallis India, where Tata Chemicals is the promoter, surged nearly 16% to hit a new one-year high of Rs 294.25 on Thursday. Tata Investment Corp shares were locked in the upper circuit for the sixth straight day, surging 5% to close at Rs 9,756.85. The stock has advanced 77% in the last one month.

Read More: IIFL Finance Shares Rise 10% After Fairfax Commits $200 Million Liquidity Support

Mehta added, “Market participants say that Tata Sons is expected to raise Rs 55,000 Cr via an IPO and many of the known Tata group names hold stakes in Tata Sons. With one example Tata Chem’s , it hold 2.53% of Tata Sons and that is Rs 30,000 crore in value, the current mcap of Tata Chem is Rs 29,000 Cr which had fuelled the rally in last few days like wise in other group stocks as well.”

As per data available on Tata Sons’ website, Tata Motors held 3.06% stake in Tata Sons as on March 31, 2023. Tata Power held 1.65%, Indian Hotels held 1.11%, Tata Chemicals held 2.5% and Tata Steel held 3.06%. Mehta said that market sentiment sees it as a great opportunity with high potential with limited downside if the Tata Sons listing proceeds would be as per market reports which can also be speculative by nature.

Spark Capital has pegged a Rs 7.8 lakh crore valuation for the Tata group’s NBFC holding company Tata Sons on listing going by the current market cap of the group firms.

Read More: Gopal Snacks Limited IPO: Check subscription, latest GMP

The equity research company derives a value of Rs 7.8 lakh crore, assuming a 60% holding company discount and Rs 1 lakh crore as the value of the optionalities.