Among some of the popular destinations for Indian travellers, Thailand has an average ATM withdrawal fee of 2.62%, Singapore at 1.41% and Australia at 1.15%

Read More: Paytm crisis: Can Paytm FASTag users port their accounts to other banks? Here are the details

Wise, the foreign exchange financial technology company, recently revealed crucial insights into ATM withdrawal fees for Indian travellers visiting popular APAC destinations. The latest research tapped on its database to shed light on the potential costs associated with cash withdrawals abroad, helping travellers to get the most out of their vacation budgets.

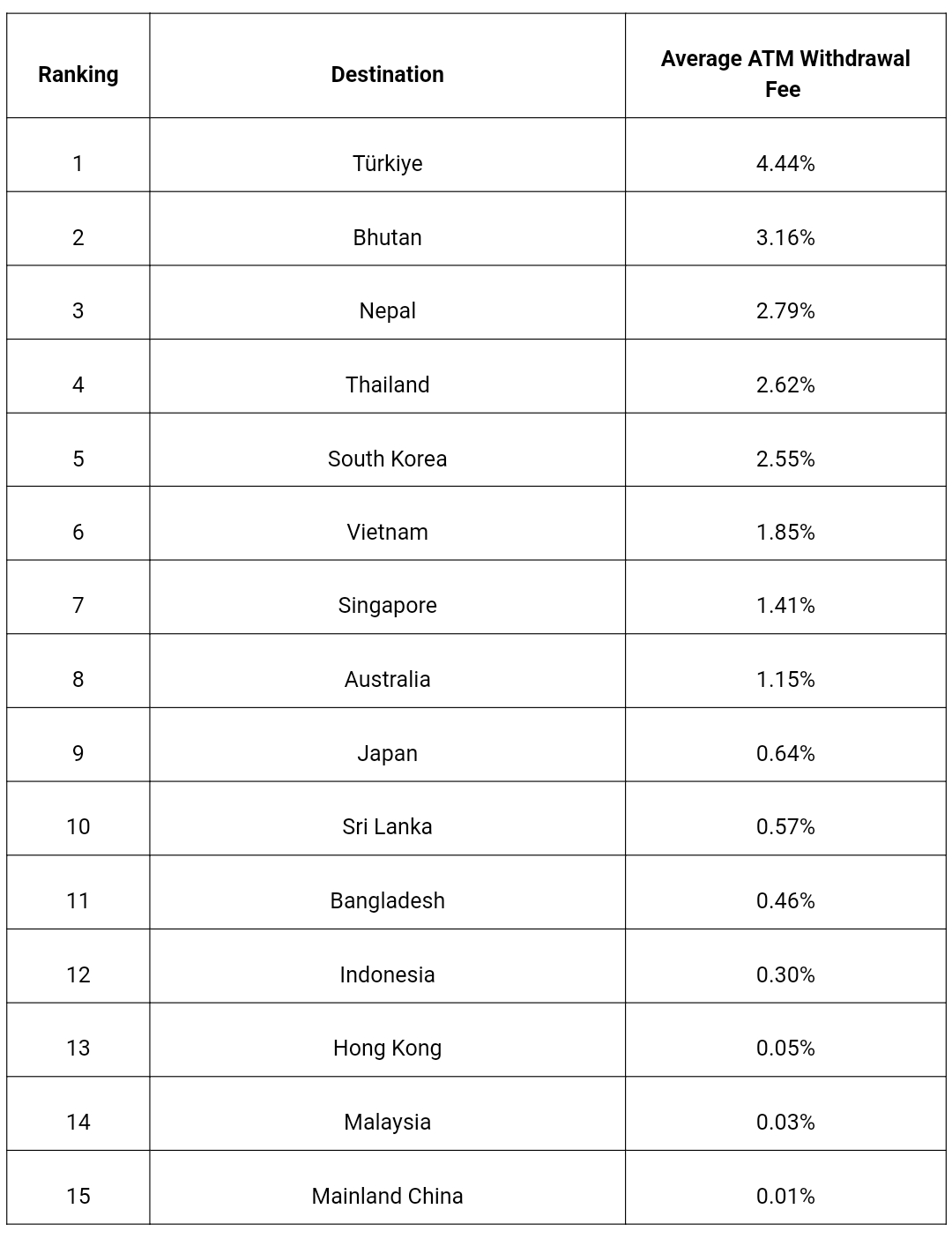

The data, focusing on destinations in APAC, revealed that Türkiye topped the list as the most expensive place in the region to withdraw cash at ATMs, with travellers charged 4.44% per transaction on average.

As the new year commences and with an increasing number of Indians looking ahead to international travel, these insights provide valuable guidance for smarter financial planning throughout 2024.

Among popular travel destinations for Indians, Thailand ranked 5th at 2.62%, followed by South Korea (2.55%), and Vietnam (1.85%). In contrast, mainland China and Malaysia have some of the lowest fees at 0.01% and 0.03% respectively.

ATM fees in major APAC travel destinations:

To put this into perspective, if someone withdrew Rs 10,000 per day for a week in Türkiye, they’d pay an equivalent of Rs 3,108 in fees. In contrast, if they visited Malaysia and took out the same amount of cash, they would only pay Rs 21 in transaction fees.

Read More: PM MUDRA Yojana (PMMY): Who Is Eligible And How To Apply

When transacting in a different currency, it’s important to be aware of potential hidden expenses, which can often include foreign transaction fees and undisclosed exchange rate markups. These seemingly small charges can add up to a substantial amount.

Surendra Chaplot, head of global product, Wise, said, “When it comes to international payments, it’s crucial to be aware of potential hidden expenses, which can often include foreign transaction fees and undisclosed exchange rate markups. This affects anyone who has ever needed to move or manage money in a different currency, including withdrawing cash abroad. Wise is dedicated to raising consumers’ awareness about hidden fees in all forms of cross-border payments, so that they can make the most out of their money.”

To help Indian travellers make informed financial decisions and stretch their holiday budget during international trips, Wise has also put together these tips for holidaymakers to keep in mind:

Research where to withdraw money. It may be cheapest to do this before leaving, but avoid money exchangers at the airport. If you really need to withdraw cash abroad, consider comparing ATM rates at multiple locations, as fees can vary from bank to bank.

Check the fees your card provider charges for overseas withdrawals, which can be expensive.

Some providers offer free ATM withdrawals abroad up to a certain threshold.

When swiping your card in stores, choose to pay in the local currency instead of in Rupees to avoid dynamic currency conversion charges

If you’re travelling to visit friends and family, consider using credible platforms/apps to send money to those who can help to withdraw at a local ATM. This way, you avoid expensive ATM fees, foreign transaction fees and poor exchange rates all at once.

Read More: How To Upload Profile Picture In EPF UAN portal

Methodology of the study

Wise said that the data is based on 8.4 million analysed cash withdrawals made with a Wise Card at 3rd party ATMs over 6 months, from May 2023 to November 2023. These ATMs recorded at least 500 transactions per country during the 6 months.