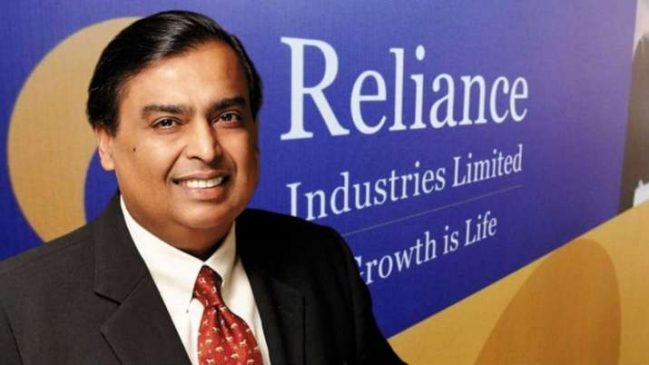

Mukesh Ambani-led Reliance Industries recently crossed the ₹20 lakh crore in market value, retaining its title of most valued company in India.

Billionaire Mukesh Ambani-led Reliance Industries Limited (RIL) this week ended up touching a new height as the most valued company in India, with its market capitalisation crossing ₹20 lakh crore for the first time, creating history.

Read More: India’s Stand on Pharma, IPRs in Trade Pacts Help Promote Growth of Generic Industry: GTRI

RIL became the first Indian company to have a market value of more than ₹20 trillion, with its shares hitting a record high of ₹2,967 in intra-day trade on February 14. The landmark achievement places the company at the 49th position among the world’s top 50 companies by market capitalisation.

With this significant achievement, Reliance surpasses major global firms like Cisco Systems, Pepsi Co and Shell Plc. Factoring in the market cap of Jio Financial Services, Reliance is now worth more than giants like Netflix and Accenture.

The combined market cap of Reliance Industries and Jio Financial Services, which demerged from its parent company last year, puts Ambani’s firm at the 43rd position among the top 50 most valued companies.

Read More: Latest Layoffs: Nike Plans to Cut Over 1,600 Jobs or 2% Workforce

In his address to Reliance employees in December 2023, RIL Chairman Mukesh Ambani expressed confidence that Reliance will grow to rank among the top 10 business conglomerates of the world.

Not just this, but Reliance has also emerged as the top wealth creator of Dalal Street in the last few years, gaining an average of ₹1 lakh crore in market valuation per year over the last two decades on average.

RIL, in US dollar terms, is currently worth over $241 billion and is the only Indian company to feature on the world’s 50 most valued companies. Meanwhile, the second largest company in India, TCS, is ranked 66th on the list with a market cap of ₹15 lakh crore.

Read More: Busy Bee Airways and Ajay Singh’s SpiceJet submit joint bid for GoFirst

Reliance-Disney merger in the works

It is expected that the upcoming mega-merger of Reliance with Disney Star’s India wing is expected to help Jio get a more prominent position in India’s media industry. The much-anticipated merger is also expected to reward Reliance and Jio shareholders if all goes to plan.

Reliance is currently in the works of buying around 30 percent stake in Tata Play from Walt Disney, leading to the first-ever collaboration between Mukesh Ambani’s company and the Tata Group conglomerate.

Further, Reliance also has the potential to be the first Indian stock that reaches $1 trillion, with strong competition from HDFC Bank and Bajaj Finance.