National Pension System, or National Pension Scheme (NPS) is a government investment plan focused on retirement planning. The scheme, which is open to government as well as private sector employees, can help one achieve financial freedom at retirement through a regular monthly contribution. Since NPS provides compounding, one can create a huge corpus with consistent investments in the long run. An investment of 10,000 a month may also help one get over Rs 1.50 crore in a lump sum and over Rs 1.14 lakh monthly pension. Know how!

NPS: Retirement planning is an important aspect for people seeking financial freedom and a relaxed life post retirement. There are many investment schemes focused on retirement. Some of them assure guaranteed returns; some offer lump sum amount on retirement; and others offer a monthly pension. National Pension Scheme, or National Pension System (NPS) is a scheme that gives the option of having a lump sum amount at the time of retirement and a monthly pension after that. A disciplined investment approach in NPS can help one create a huge corpus with a low investment amount.

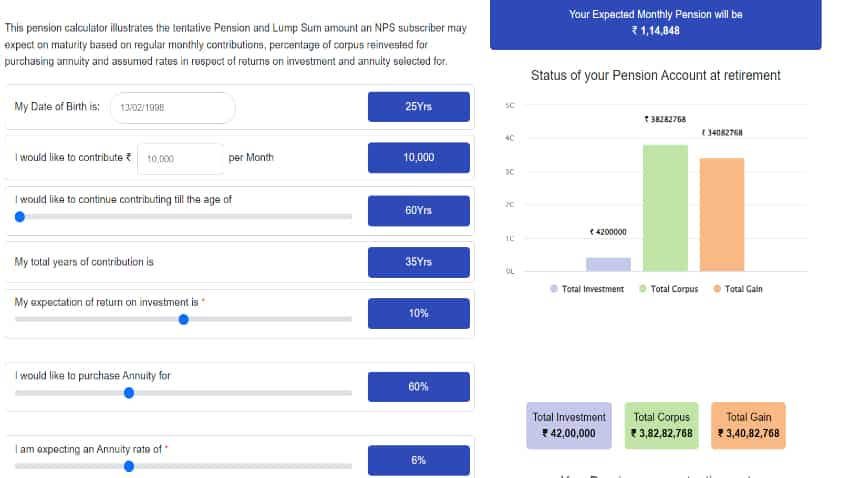

A monthly investment of just Rs 10,000 can help one accumulate a decent lump sum of over Rs 1 crore and a monthly pension of over Rs 1 lakh.

Before we reach calculations, let’s know more about what NPS is and how it works.

Read More: Federal Bank Revise Interest Rates On fixed Deposits; Know New Rates inside

What is NPS?

The central government started NPS for central government employees in 2004.

The basic principle of the scheme is that the employee deposits monthly installments in their NPS account.

The government invests this amount in ‘safe’ and regulated market-linked investment options.

At the time of retirement, the employee gets the lump sum amount and a monthly pension from investments.

One can get a maximum of a 60 per cent lump sum, as it is mandatory to invest at least 40 per cent of the total corpus in annuities.

These annuities are generally debt funds that provide returns for an assured monthly pension.

One also has the option of not withdrawing a lump sum at the time of retirement and investing all their corpus in annuities.

It will ensure them a higher pension.

After the central government launched the NPS scheme, many states also followed the path and implemented it.

Read More: How To Apply For An Instant Loan Online And Get Funds In Minutes

Is NPS also applicable to private sector employees?

The government also opened the scheme under the name of National Pension Scheme for private sector employees.

“NPS Corporate Sector Model is the customized version of NPS to suit various organizations and their employees to adopt NPS as an organized entity within purview of their employer-employee relationship,” the NPS website says.

NPS: Who can open an account?

Any Indian citizen (both resident and non-resident) between the ages of 18 and 70 is allowed to open an NPS account.

Non-resident Indians (NRIs) are also allowed to open their NPS accounts.

NPS: Types of accounts

NPS offers Tier-I and Tier-II accounts. The NPS-I account comes with a lock-in period where you can withdraw funds only at age 60.

There is no such condition in a Tier-II account.

In a Tier-I account, the account holder gets a maximum of 60 per cent of the total corpus as a lump sum, and the rest of the amount is invested in an annuity plan, whereas there is no such facility available in a Tier-II account.

Employees from both the government and private sectors are allowed to open Tier-I and Tier-II NPS accounts.

NPS: Tax benefits

Employees in the government as well as the private sector with Tier-I accounts can enjoy tax deductions up to Rs 1.50 lakh under Section 80CCD.

One can also claim further tax benefits of Rs 50,000 under the Tier I scheme.

Read More: Bajaj Allianz launches Life Assured Wealth Goal Platinum Smart Income: Check plan features, details

NPS: What can a Rs 10K monthly investment do?

NPS investments are compounded, which means you get returns on your overall corpus and not just on your yearly investment.

So the longer you stay in the scheme, the more monetary benefits you get.

With compounding, your small contribution helps create a sizeable corpus in the long run.

An investment of just 10,000 a month for 35 years can help you create a Rs 1.53 crore corpus and a monthly pension of nearly Rs 1.15 lakh.

Before we let you know about these calculations, let’s lay down some investment conditions.

Since we need a huge corpus and a sizeable monthly pension, we need to start investing early.

So, we are taking 25 years as the investment age.

We are taking a Rs 10,000 monthly investment since a lot of NPS accountholders may afford that money.

We are assuming the accountholder will invest in NPS till the age of retirement (60 years), which means they will invest Rs 10,000 a month for 35 years.

The long-term will compound their investment and help them get a good amount at retirement.

We assume that the NPS accountholder will get 10 per cent annual returns from their investment and six per cent returns from annuities post retirement.

With these conditions, we will start our calculations:-

If the accountholder invests Rs 10,000 a month for 35 years and gets an annual 10 per cent return on it, their investment in that period will be Rs 42 lakh, the estimated long-term capital gains will be Rs 34082768 (Rs 3.41 crore) and the total corpus will be Rs 38282768 (Rs 3.83 crore).

If you decide to withdraw a 60 per cent amount at the time of retirement, you will get Rs 22969661 (2.30 crore) as a lump sum, and the rest, Rs 15313107 (Rs 1.53 crore), will be invested in annuities.

NPS calculation chart

That amount will give you a monthly pension of Rs 76,566 at six per cent annual returns.

Since our target is to get a Rs 1 lakh monthly pension at least, we will change the withdrawal conditions for us a bit.

Instead of withdrawing 60 per cent, we will withdraw only 40 per cent and invest 60 per cent in annuities.

With that condition, your lump sum amount will be Rs 15313107 (Rs 1.53 crore), while your annnuity value will be Rs 22969661 (2.30 crore).

If you invest Rs 2.30 crore in annuities, it can get you a monthly pension of Rs 114848 (Rs 1.14 lakh).

Since you have the option to invest all your corpus into annuities, if you do that, you can get a monthly pension of Rs 191414 (Rs 1.91 lakh).

This is what a disciplined investment with a small amount of Rs 10,000 can do.