Senior citizens typically earn an additional 0.50% interest on their FDs compared to regular FDs. This can make a significant difference in the total earnings.

Senior citizen fixed deposits are investment instruments specifically designed for people above 60 years or above. This product offers several benefits tailored to the needs of senior citizens, and it’s essential to consider various factors when investing in them.

Firstly, interest rates play a crucial role in determining the returns on senior citizen fixed deposits. Typically, these deposits offer higher interest rates compared to regular fixed deposits, making them an attractive option for retirees seeking stable income. However, it’s vital to stay updated on prevailing interest rates to ensure that the investment remains competitive.

Read More: Home loan, other loan interest rates revised: List of 8 banks with new rates in January 2024

Adhil Shetty, CEO, Bankbazaar.com, says, “Senior citizens typically earn an additional 0.50% interest on their FDs compared to regular FDs. This can make a significant difference in the total earnings, especially for longer tenures. For example, if a regular FD offers 6% interest for a 5-year tenure, a senior citizen FD might offer 6.50% interest for the same tenure.”

Another important aspect to consider is the tenure of the fixed deposit. Senior citizens should choose a tenure that aligns with their financial goals and liquidity requirements. Shorter tenures may offer flexibility, while longer tenures can provide higher interest rates.

Tax implications should be taken into account as well. While the interest earned on fixed deposits is generally taxable, senior citizens are eligible for a higher exemption limit. It’s advisable to be aware of the tax rules and consider the after-tax returns when making investment decisions.

Read More: Senior citizen savings scheme: Know SCSS interest rate for the January-March 2024 quarter

Liquidity is a crucial factor, especially for seniors who may need funds for medical emergencies or other unforeseen expenses. Opting for a cumulative fixed deposit that compounds interest and matures at the end of the tenure can be a prudent choice to ensure both returns and liquidity.

Lastly, it’s essential to review and reassess the investment strategy periodically. Economic conditions and interest rate scenarios may change, impacting the performance of fixed deposits. Regularly monitoring the investment portfolio and making adjustments can help senior citizens optimise returns and secure their financial well-being post retirement.

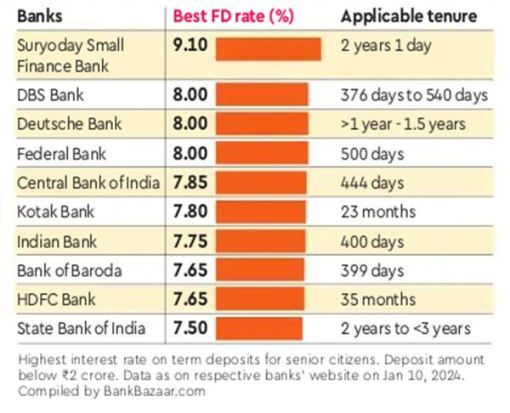

Here is a list of the 10 banks, including SBI, HDFC Bank and Kotak Bank, offering the highest senior citizen fixed deposit interest rates.

Read More: Bank Of Baroda Launches ‘Bob 360’, New FD Scheme Offering High Returns

Senior Citizen Fixed Deposit Interest Rates