SBI Green Rupee Term Deposit is a special fixed deposit scheme offered by the State Bank of India

SBI FD Scheme: The State Bank of India (SBI), the largest lender in the country, has recently introduced the SBI Green Rupee Term Deposit (SGRTD). A special fixed deposit scheme, it aims to raise funds for environment-friendly projects.

Read More:- Income Tax: Top banks offer these interest rates on tax saving fixed deposits. See details here

According to SBI, it is an initiative to mobilise funds for financing green activities and projects and developing the green finance ecosystem in the country, by SBI.

SBI Green Rupee Term Deposit: Who Can Apply?

The deposit scheme welcomes participation from resident individuals, non-individuals, and non-resident Indian (NRI) customers.

Read More:- Tata Power’s renewable energy arm inks deal with Gujarat govt, may generate 3,000 jobs

Tenure Available

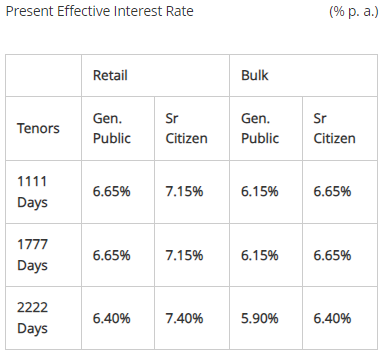

GRTD provides investors with the option to select from three different terms: 1,111 days, 1,777 days, and 2,222 days.

How To Apply?

Currently, the scheme is available through the branch network of the bank. SBI has said that it will soon be made available through digital channels such as YONO and Internet Banking Services.

Read More: HDFC Life Q3 net profit soars 16% to Rs 365 cr amid market surge

SBI Green Rupee Term Deposit Interest Rate

Offers interest rates slightly lower than regular SBI fixed deposits (currently 6.15% – 7.40% p.a. compared to 8.15% – 11.15% p.a.).

SBI said that senior citizens/ staff/ staff senior citizens are eligible for additional interest rates over the applicable rate for the public under the scheme. However, the benefit of additional interest shall not be available to NRI senior citizens / NRI staff.

Read More: Gold Rate Rises Today In India: Check 24 Carat Price In Your City On January 13

Loan facility

A loan/ overdraft facility is available against the deposit

TDS

TDS is applicable as per Income Tax rules.